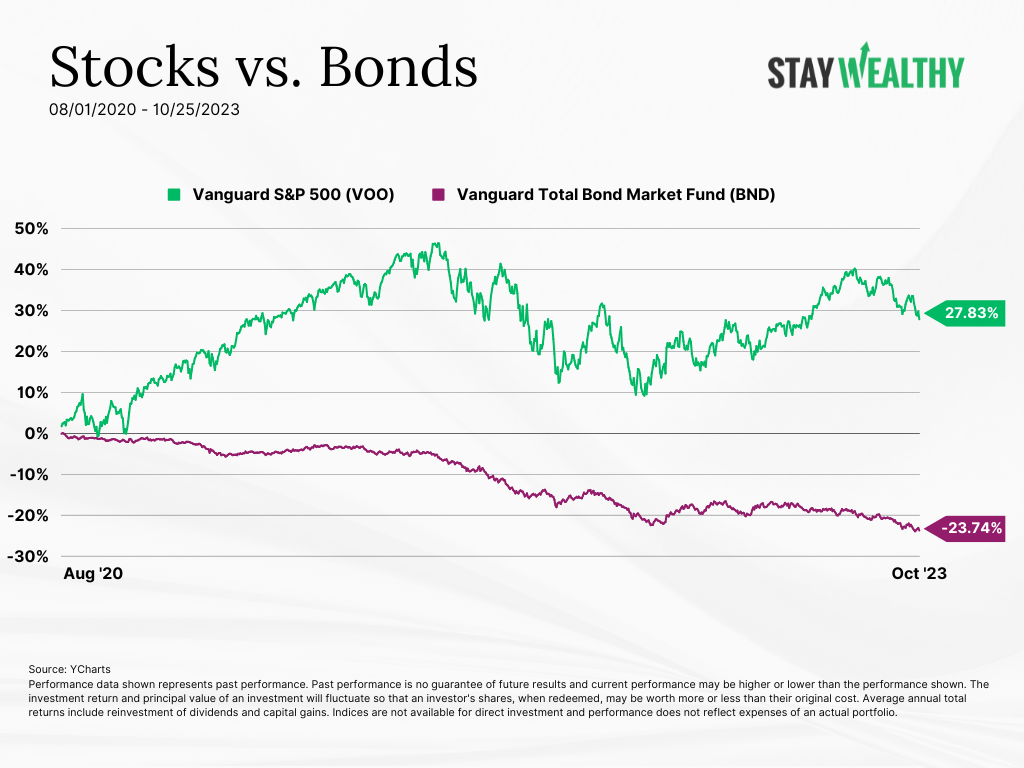

Bonds are down 20%+ over the past three years.

Meanwhile, risky asset classes (like U.S. stocks) are UP ~30% during the same period.

- What the %@#! is happening to bonds right now?

- Why are safe asset classes down double digits while risky asset classes scream upward?

- Should retirement investors consider changes?

- Are money market funds and CDs a better solution than bond funds?

- And what might all of this mean for the future of bond investing?

I’m answering these questions (and more!) in this two-part series on bonds.

Need Tax + Retirement Planning Help?

We specialize in helping people aged 50+ lower taxes, invest smarter, and (safely) create a retirement paycheck.

Our Free Retirement Assessment™ will answer your BIG questions and help you properly evaluate our firm.

Click the banner below to learn more. 👇

How to Listen to Today’s Episode

🎤 Click to Listen via Your Favorite Podcast App

Stocks vs. Bonds (Aug 2020 – Oct 2023)

Episode Resources

📬 Want more retirement and investing content? Join thousands of listeners and subscribe to the Stay Wealthy Retirement Newsletter!

- Stay Wealthy 4-Part Bond Investing Series:

- Should Retirement Savers Own Bonds? [Stay Wealthy]

- Bond Duration Hypothetical Example [Dimensional]

- The Six Biggest Bond Risks [Investopedia]

- Vanguard Total Bond Market Index Fund [Vanguard]

- Vanguard Long-Term Treasury Fund [Vanguard]

- The Costs of Buying/Selling Individual Bonds [SSRN, Harris]

- Why Bond Funds Aren’t Necessarily a Losing Proposition in Rising Rate Environments [Kitces]