Emerging Markets are the world’s primary drivers of global growth (and wealth accumulation).

Just over 50% of the world’s economic output comes from these countries. 🤯

They play a crucial role in shaping global economic trends…

…but most retirement investors don’t fully understand this asset class.

To help break it down for us, Emerging Markets expert and founder of Life + Liberty Indexes, Perth Tolle, stops by to discuss:

- What Emerging Markets are and why retirement savers should consider investing in this asset class

- Why traditional, low-cost emerging market funds may produce lower returns

- The pros/cons of excluding countries like China and Russia from an Emerging Markets fund

We also discuss why “freedom” plays an important role in this asset class and how investors can (potentially) use freedom metrics to capture higher returns.

Listen To This Episode On:

When You’re Ready, Here Are 3 Ways I Can Help You:

- Get Your FREE Retirement & Tax Analysis. Learn how to improve retirement success + lower taxes.

- Listen to the Stay Wealthy Retirement Show. An Apple Top 50 investing podcast.

- Check Out the Retirement Podcast Network. A safe place to get accurate information.

+ Episode Charts

+ Episode Resources

- Perth Tolle:

- Human Freedom Index [Cato Institute]

- Vanguard Emerging Markets ETF

+ Episode Transcript

How to Invest in Emerging Markets

This show is a proud member of the Retirement Podcast network.

Taylor Schulte: Perth Tolle was born in Beijing, China. She came to the US at the age of nine and after graduating from Trinity University in San Antonio, Texas, she went back to China to live with her father for a year and reconnect with her Chinese roots.

During her time there, Perth met a 23-year-old named Maggie. While both were the same age, they had wildly different upbringings. Maggie didn’t have school records, she didn’t have hospital records, she didn’t even have a birth certificate to the Chinese government. Maggie did not exist, and that’s because along with tens of millions of other kids, she was a victim of the Communist Party’s one-child policy.

The one-child policy was in effect from 1980 through 2015 and was implemented to curb the population growth in China. Since Maggie’s parents already had a child, they had to hide her existence from the government.

Perth told Forbes in 2022 that policy changed the culture of my generation and the effects of the demographic disaster in China are irreversible. Unlike the United States and other developed countries, China is not a free nation. And Perth’s time with Maggie made her realize that growing up in America, growing up with freedom made a giant difference in her life.

This realization also led her to hypothesize that freedom likely made a difference in the markets as well. Freer markets have more sustainable growth. They recover faster from drawdowns, and they use their capital and labor more efficiently, Perth told Forbes.

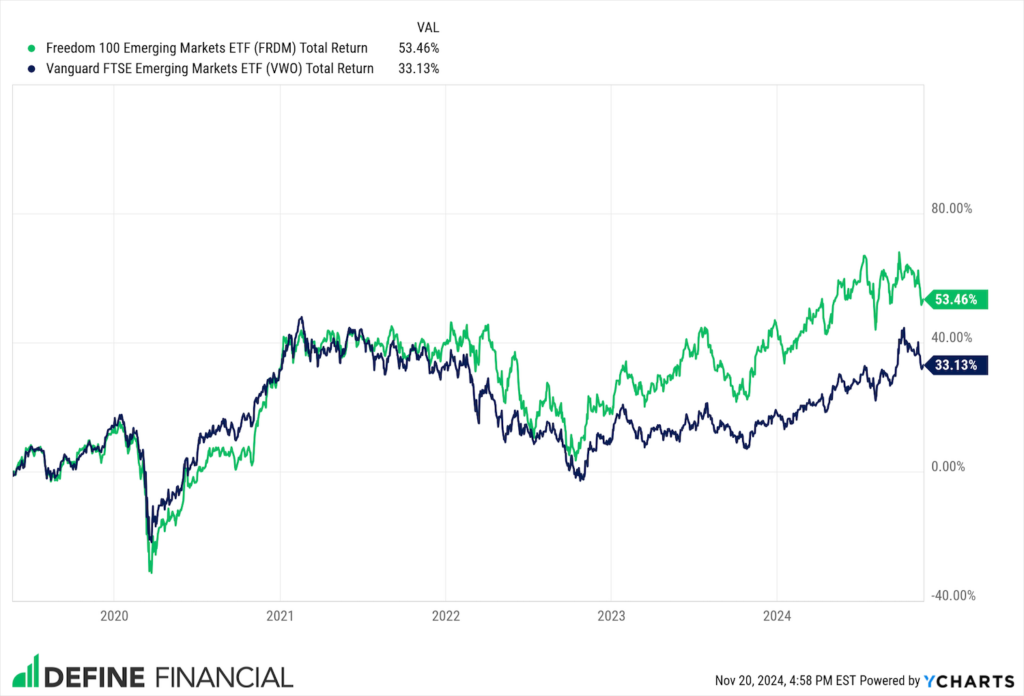

Perth was a guest on this podcast in 2019, right around the time of the launch of her new fund, the Freedom 100 Emerging Markets Fund ticker FRDM, short for Freedom. Since the ETF launched five and a half years ago, it has produced a total return of 52%.

Meanwhile, the ultra-low-cost Vanguard Emerging Markets Fund, ticker VWO returned just 31% during the same time period. Strong performance of a fund is one thing, actual dollars committed is another. Since Perth was last on the show, her fund has grown to $950 million of assets under management, nearly $1 billion.

It’s important to note here that Perth is not actively trading emerging market stocks every day to try and beat the market. When she launched the fund, she partnered with the Cato and Fraser Institute, which developed an index called the Human Freedom Index scoring 165 countries based on how free they are.

The index rates, economic and personal freedom on a scale of 0 to 10, using 82 variables covering everything from jail journalists to international trade policy. In short, the emerging markets with the highest freedom scores get the highest weight in the index that she created The Life and Liberty Freedom 100 Emerging Markets Index.

In other words, Perth does not personally decide which emerging countries are included in her fund or the allocation weightings the Life and Liberty Index does. And as you might imagine, a country like China, which typically has a very high allocation in most emerging market funds, is not included in her fund due to their incredibly low freedom scores.

Now, while the Freedom 100 Fund is passively tracking the Life and Liberty Index, much like a fund might passively track the S&P 500 index, you could argue that its algorithm is actively choosing to include and exclude certain countries based on their freedom scores and anytime active decisions are being made. And we veer from major broad-based indexes that own everything, the odds of underperformance go up.

That being said, actively deciding to overweight the freest emerging market countries and underweight or even exclude countries with low freedom scores and the worst human rights records has led to sizable outperformance since the launch of the Freedom 100 Fund.

Will the outperformance continue? Time will tell, but if investing in emerging markets and specifically emerging markets with high economic and personal freedom scores is important to you, you’re going to enjoy today’s episode.

Welcome to Stay Wealthy podcast. I’m your host, Taylor Schulte, and today I’m talking about investing in emerging markets. Specifically, I’m joined by Perth Tolle, founder of the Freedom 100 Emerging Markets Index, and we discuss three important things.

Number one, what emerging markets are and why retirement savers should consider including an allocation to them in their portfolio.

Number two, how traditional low-cost emerging market funds are constructed and some of the potential issues that investors may want to take into consideration.

Finally, number three, the pros and cons of excluding countries like China and Russia from an emerging markets fund. We also discuss Perth’s expectations for her index going forward and what changes she might make to the methodology in the future.

To view the research and articles supporting today’s episode, just head over to youstaywealthy.com/230.

Perth Tolle: In the investing world as far as equities, there’s basically three different categories for international stocks. So you have developed markets, which are the bigger countries such as Japan, Germany, France, Denmark. Those are the countries that are quite developed, have very open trade, very open capital markets and so forth. They’re larger markets as well. And then you have the second category, which is emerging markets. And this is what we’re talking about here, and that is the less developed markets.]

So these are markets that are societies transitioning from typically authoritarian type of government to a more free market-oriented economy. So they have increasing economic freedom, increasing integration with the global marketplace, and expanding middle class, improving standards of living.

So these are markets that you’re familiar with, like China, Russia used to be in here, Saudi Arabia, those are the less free ones. And there’s more free ones like Taiwan, South Korea, Chile, Poland, and some of those that I just mentioned are candidates for graduating into developed. So that’s the second category.

And then the last category in international investing as far as classifications is frontier markets. And these are the tiniest markets that have stocks at all, and they are even smaller than emerging markets. So these are countries like Vietnam, Kuwait, Nigeria and so forth. So these are even smaller than emerging.

So you have developed emerging and frontier markets and emerging markets are those in the middle where they’re not fully developed, but they have transition from a less free to a more free market-oriented economy.

Taylor Schulte: How often do these countries hop around from index to index? How often does a country move from a frontier market into an emerging market or from an emerging market into a developed international market? Maybe the better question is what’s the last country you can recall that move from frontier to emerging or from emerging to international developed?

Perth Tolle: There’s some countries that just keep popping around. Like Greece for example. Greece went from emerging to developed back to emerging. And then there’s countries that go to standalone, like Argentina I believe has gone to standalone. And the people that determine this is the big indexers, like MSEI, who set these classifications and FSE.

So it’s not the World Bank or IMF that determines in the investment world what is considered a emerging versus developed market. It’s MSEI. So it’s their criteria and their committee that typically determines these things.

Sometimes you’ll have a market event that forces their hand like Russia invading Ukraine, and then their market basically becoming completely untradeable. And they obviously are now no longer in the emerging category. They’re standalone.

So it depends on the situation, but there are movements, however, in the emerging market space in the last five years, it’s gone from 23 to 27 to 25, back to 24. As far as MSEI classifications, and each indexer will have their own classifications. So for us, it’s typically around 18 that are emerging markets in the investible category.

Taylor Schulte: Is it fair to sum this up to say the frontier markets, the countries in the frontier markets are the smallest of the smallest emerging markets a little bit bigger, and then your developed international or even bigger, and is it maybe fair to draw a parallel to micro-cap stocks in the United States to small-cap stocks to large-cap stocks? Would that be a way to think about frontier emerging and developed?

Perth Tolle: Yes, that’s a perfect way to think about it. And in addition, because right now emerging markets and even internationally developed are so much more favorably valued. So their valuations are so much lower than US stocks. You can also think of it as value versus even the US stocks, which would be more, I guess, growthy in this comparison.

Taylor Schulte: It’s a nice segue to my next question, which is why would a retirement saver want to include an allocation to emerging markets in their already diversified portfolio of stocks and bonds? What’s the benefit of adding a meaningful allocation to emerging markets to a portfolio and maybe what are some of the risks and drawbacks that an investor should take into consideration?

Perth Tolle: So the diversification benefit is absolutely there, especially if you’re using the stocks that are listed on the local exchanges, in the local currencies, in each of these markets that you would not have access to just investing in US listed stocks. So some of the biggest emerging markets companies like TSMC for example, that’s Taiwan semiconductor manufacturing company that does have a listing, a DR listing on the US exchange.

Most of the emerging markets stocks are not listed on US exchanges, and those are markets that are contributing to basically 60% of the world’s GDP. So 60% of GDP does come from the emerging markets. 85% of the population world population lives in emerging markets, but the emerging markets only account for about 10% of market capitalization in global indices. So those stats, I think MEB Faber tweeted out recently. So he likes to stir up the controversy with these emerging markets tweets because he’s very into diversifying into emerging markets.

So shout out to med there. But yeah, that’s one reason. The other reason is right now, as we mentioned, it’s just extremely cheap compared to both developed and US markets, especially US markets. So yes, there is some diversification that you will have exposure to by investing just in US markets to emerging markets because some of these companies to operate overseas, but there is a lot more out there that can benefit investors as far as diversification in the local markets themselves.

Now, the risks to that, obviously in emerging markets, you’re going to have a lot more political risk. So this is why for a lot of investors, emerging markets seem very scary or an unnecessary risk because there’s just too much. For example, autocracy risk is something that we address in some of these markets like China, Russia, Saudi Arabia, Egypt, Turkey, there is a lot of uncertainty due to the capriciousness of government actions, the infringement into private market activity by the governments.

All of these things are very bad for investors and it makes it more difficult to capture the returns in the markets even if there is very real growth on the ground. So for example, in China, the last four decades, we saw very real growth on the ground.

However, investors were unable to capture any of that growth. If you look at the MCHI index, which is the MSEI, China onshore and offshore index, the returns during that same time period since 1992, the of the index are basically worse than treasuries. So for all of that risk and for all of that actual growth on the ground, investors did not capture any of it. This is that autocracy risk that we’re talking about is that some of these markets is very difficult, even if there is real growth on the ground to capture it in the financial markets in stocks.

So we want to avoid places like that where the government can siphon off returns to players other than foreign investors in the way that the structures are set up and the non-transparency of accounting standards and so forth. And also we want to be in places where companies are free to act in their own best interest versus in the best interest of the government always putting the government’s interest before their own.

So those are some of the risks when you’re investing in emerging markets that you’ll encounter these types of very authoritarian political systems that eat into your returns or prevent companies from being everything that they can be if they can have a free market. So this is something that we try to avoid in our strategy as well.

Taylor Schulte: Yeah, so in your strategy, there are potentially some ways to mitigate some of the risks that you just mentioned, but setting that aside, just investing in these smaller emerging countries, it just does contain more risk and in return, you should expect a higher long-term return for taking that extra risk. You’re not going to get that premium or that extra return without that risk. You had mentioned the two benefits are why you might consider including an allocation being current valuations.

So we look at just the global markets. There’s asset classes like the US market that have just been screaming upwards. Then there’s asset classes like emerging markets that have been pretty beaten up for a while at least compared or relative to some of these other asset classes. So there’s potentially a valuation opportunity here to buy an asset class with lower valuations and higher future expected returns.

And then you also mentioned the diversification benefit. I’ve talked a lot here on the show about the last decade from 2000 to 2009, and emerging markets during that time period was a great saver for portfolios, for diversified portfolios, for those that had an allocation to emerging markets.

So from a diversification standpoint, especially for retirees who are relying on their portfolio for regular withdrawals, this sort of diversification benefit is really important if an investor is convinced or maybe partially convinced that they should have an allocation to emerging markets along with their developed international stocks.

Let’s talk a little bit about how these typical low-cost, broad-based emerging market funds are typically structured. So these are your market cap-weighted funds, and I’ve done an episode on market cap-weighted funds and what that means.

But how are these traditional low-cost, let’s just call it the Vanguard, low-cost emerging markets, ETF or mutual fund, how are those typically structured? And then let’s talk about how you can maybe change that structure to improve how you invest in emerging markets.

Perth Tolle: The way that most indexes are structured, they’re market cap-weighted like you said, and this just means, as you know, the market cap companies. And as a result, countries get the biggest weight in the index. Now in the developed markets, these are the markets like Germany, Japan, the biggest markets. This strategy works really well because it gives you the most tradable type of universe for investors, and it’s just a highly efficient way to capture those markets.

Now, those markets are all the developed markets typically pretty free, pretty homogenous in their freedom levels. So you don’t have the issues that you had in emerging markets where if you market cap weight in the emerging markets, what you’re getting is a massive overweight to some of the biggest autocracies. So China, for example, has about 30% in the market cap-weighted emerging markets indices at its height.

In August of 2021, it was 41%. So that’s a lot of concentration in one country and whatever country it is, but especially in a country with all the risks, all the autocracy risks that China has, Russia was in the top 10 before it was kicked out, and Saudi Arabia is still in the top 10 in most market cap-weighted indices. So an investor who has these market cap-weighted indices and their products in the emerging market space is basically a lot of times unintentionally funding money to autocracies. And that’s something that my investors are typically trying to avoid.

Taylor Schulte: If you go and buy the Vanguard emerging markets, E-T-F-V-W-O, it’s cost basically nothing to own this fund. 30% of your money in this fund is being allocated to China as of today. And you’re saying that there’s a potential risk there. You may not want to have that size of an allocation to China, you may not want to own China at all. Maybe dive a little bit deeper here. Why wouldn’t somebody want that large of an allocation to China? Why would somebody want to maybe exclude China entirely from an emerging market allocation?

Perth Tolle: Autocracy drag is something that China is like the poster child for right now, just because in the last five years we’ve seen very bad returns from this market and also we don’t see very good potential for improvement in the near future. So China has in the past 40 years, like I said, grown a lot, but investors haven’t captured any of that growth.

And a lot of that growth was debt driven, government-mandated, and some of it is questionable as far as their actual GDP because some of that GDP is from the government commanding essentially planned commands to build empty buildings or whatever it is to basically boost that GDP.

And in a place where you don’t have transparency of data or you don’t have transparency of ownership structures and you don’t have transparency of accounting standards, you don’t really know what you’re owning and the structure in which you own the stocks is not one that is favorable to for investors.

It’s just very difficult to capture growth, even if there is any. And then if you have a market like China, for example, that in the near future there’s unfavorable demographics, there’s unfavorable geopolitical balances, there’s more inwardly focus as far as trade and less open trade, less open capital markets and not going the right direction in general, as far as human rights and economic freedoms, that’s just not what we want to be.

We believe that as far as index investors, the best places to be are the ones where you’re going to capture the next big growth story. You want that next Apple, Google, Microsoft, or whatever the next big growth story is going to be in emerging markets. And we don’t believe that those are going to come out of the autocracies. We believe that best places to find those stories are the places that have the foundations of both personal and economic freedom place, the places that have stronger institutions, stronger rule of law, stronger protections for individuals and for IP and for private property.

And so those are the places that will engender the next big growth stories. And as an index investor, that’s what you want to capture. So that’s where we want to be.

Taylor Schulte: You’ve alluded to this a little bit already, but I want to make sure it’s very, very clear for everybody listening, I want you to talk to us about the relationship between freedom and investing in our investing decisions. What do you mean by freedom? Can you define freedom a little bit more for us? How we evaluate freedom and how a country is maybe freer than another country, and how this relates to some of our investing decisions and how you’ve structured the freedom index?

Perth Tolle: Yeah, that’s a great question because the benefits of freedom are pretty familiar and pretty intuitive to most people. So for example, freer countries have higher life expectancy, lower infant mortality, higher gender equality, higher GDP per capita, higher incomes for everyone, not just the richest people, but also the poorest people in the freer countries are richer than the poorest people in the unfree countries.

So all of these things are benefits of freedom that everybody kind of intuitively knows are there, but they’re a little bit nebulous. They’re not something that we can see. So what we’re trying to do here is be kind of a running scorecard for freedom in the emerging markets investing space where you can see hey, freer countries to actually outperform their less free counterparts in the long run.

So we’re trying to be that running scorecard for freedom or not. Sometimes it’ll underperform because sometimes some of these China being the example again, will have a bazooka of government intervention that causes a short-term blip of outperformance after Covid, China was the top performer in the world for the first half of 2020.

So there are times that a strategy like this will underperform as well. And it’s not just China, Saudi Arabia. So if oil does well, they might have a period of outperformance. We do still believe that the freer countries do have more sustainable growth in the long run, that that growth is more easily captured by foreign investors, that they have lower drawdowns and they have faster recovery from those drawdowns and that they use their capital more efficiently.

So even if they have resources like oil, they are more diversified in their industries and not just completely dependent on one natural resource. So these are the places that are more flexible to respond to market needs, and that’s where we want to be.

Taylor Schulte: I want to be clear here. We talk a lot about here on the show using leveraging academic research evidence-based research to drive our investing decisions. These aren’t necessarily just your opinions about investing in the emerging markets. What sort of academic data is there to support investing in freer countries when allocating to emerging markets is superior to just investing in these market cap-weighted funds where you do have a large allocation to a country like China? What sort of academic research are you leaning on to make some of these decisions?

Perth Tolle: We do use the Cato Institute and the Frazier Institute’s data as far as personal and economic freedom. Those are categorized into three categories, civil freedom, political freedom, and economic freedom. So civil freedom or things like terrorism, trafficking, women’s rights, politicals like freedom of speech, media expression, judicial independence, rule of law, economic freedom are things like private property rights, business regulations, taxation, freedom to trade internationally sound as a monetary policy and so forth. So we use third-party quantitative data to come up with our country weights and allocations, and that’s the data that we depend on.

However, there are other studies that have confirmed the theory that freer countries do outperform in the long run. The latest Nobel Prize was just given to the Acemoglu Johnson and Robinson Paper that basically says countries that democratize starting from non-democratic regimes.

So basically going from non-democratic to democratic regimes, which is exactly like the definition of the emerging markets. They do ultimately grow faster than non-democratic regimes. And the timeframe they studied was about eight or nine years that this happens in, and it’s a substantial gain. So it’s a substantial advantage for a country to have a democratic regime to have freer markets and better protections for individuals and for investors.

Taylor Schulte: So your emerging markets fund your freedom fund, ticker. FRDM currently does not have an allocation to China. There’s 0% allocation to China. Do you ever see China being included in this portfolio ever? And if so, what would it take for China to end up having an allocation to this portfolio or index?

Perth Tolle: It’s not only China that we exclude, and it’s not an arbitrary exclusion. We also don’t have any allocations. We never had any allocation to Russia even before the war. We don’t have any allocation to Saudi Arabia, Egypt, Turkey, Qatar, UAE. So all of the more autocratic, less democratic regimes in the emerging market space.

We don’t have allocations to, because the algorithm basically chooses the freest country set in the emerging market space and then weights them according to their freedom levels. So the higher freedom level countries get a higher weight and the lower freedom countries get a lower weight and the worst autocracies are naturally excluded. And that’s a dynamic process.

So yes, if China becomes more free, it can be included in the index now. Right now it is on the list like second to last on the list. Saudi Arabia is a little bit worse on the scoring or depending on the scores from these third-party think tanks.

And if the scores they start scoring higher in those 85 categories that are scored on the different various kinds of freedoms, then yes, they can come back into the index. I don’t see that happening anytime soon and they are going the wrong direction as far as the scores go on both personal and economic freedom. So I don’t see that happening anytime soon, but I would love to see that if that happened, it would be a great market to invest in, but I don’t see that happening anytime soon.

That being said, I do want to emphasize that we are not a China index, that this is not just killing China out of a cap-weighted strategy. It is a dynamic process. It is a natural result of freedom waiting, and it’s not a subjective call that I’m making. We’re looking at objective third party independent data to do the alions.

Taylor Schulte: I’m really good. You mentioned that. I was going to say the same thing that since your fund was launched, maybe this isn’t totally accurate, but from my perspective, since your fund launched and the success that your fund has had since launch, there’s been a lot more X China ETFs and funds that have been launched since then.

I don’t know if they’re riding on your coattails necessarily, but those X China funds are literally making a decision to never include China in the allocation. And what you’re saying is, yeah, right now we don’t include China in our allocation. That doesn’t mean they could never be included. This is not an ex-China fund. So if you want to ensure that you just never own China ever, ever again, you might consider one of these ex-China funds.

But I am curious to hear from you, how do you view some of those ex-China funds that have been born in recent years? How are they, other than just excluding China intentionally and never including it ever in the future, how are some of those ex-China emerging market funds different than yours?

Perth Tolle: So it’s like you said, it’s an arbitrary exclusion. And so yeah, if you’re looking to just not have China, and that’s the whole point, that’s the right fund. And I do want to acknowledge that those funds have grown substantially since five years ago, and I think that is generally a good direction because they are excluding China. Some of it is because of how China has done so badly in the past few years that nobody wants in China now.

So they’re responding to what the market is asking for the market demand, but they’re doing it in a way that’s a little more superficial than the way we do it. So we’re excluding China because of freedom reasons we had excluded Russia because of freedom reasons. We did it before it was cool, I guess. Sure.

But the China strategies, it’s kind of like trying to put a bandaid on cancer. It’s not addressing the root cause of that exclusion. It’s just addressing the very surface. Does the symptom, not the cause. It does the job of excluding China, but it doesn’t do the job of capturing the freest emerging markets country set. So it still has Saudi Arabia, Egypt, Turkey, Qatar, UAE.

In fact, those other autocracies get a higher weight because that China weight is gone out of that index. So if you’re looking for X autocracies with higher weights to freer countries, that’s more the freedom weighted strategy. That’s what we do. If you just don’t want China, but everything else is fine, then that’s the ex-China strategy.

Taylor Schulte: I think I would summarize it by saying you’re leveraging evidence and academic research that says freer countries are more likely to outperform or have higher future expected returns than non-free countries. And so we’re leveraging that evidence and research to construct the portfolio. We’re not injecting our own personal opinions here and just saying just we don’t like China. Remove China. We’re never going to include China again

Perth Tolle: From an investment perspective too. Now we have five and a half years of history. So you can actually compare the returns in the freedom weighted approach to the ex-China approach, and it does outperform the ex-China approach because it’s not only excluding a poorly performing country in that time period, it’s also a higher allocation to freer countries that added to the positive excess return.

So countries like Chile that did very well in the inflation trade, Poland was best performing emerging market last year and Taiwan this year with that tech allocation with companies like TSMC in that critical technology that they’re offering. So there’s, I think from my perspective, a benefit to increasing freedom in your allocations or as should say, exposure to the freer country set in the emerging market space. And that has proven to do better than just excluding China.

Taylor Schulte: And looking at your fund right now, the current country weight for Taiwan is just over 30%. So two questions for you there. One, what’s the highest weighting that a country can get inside this index? 30% jumps out to me, the next highest is Chile at 17%. So Taiwan is certainly well ahead of that. What’s the highest weight that a country can get in the index? And then does that cause you any concern that 30% of every dollar you put into this fund is going to one single country

Perth Tolle: Like I was an advisor and I am like you of the mindset of asset allocation diversification as pillars of the investing process. So yes, having 30% in Taiwan right now, Taiwan concerns me. Again, this is an index that we’re following a passive methodology. It’s a rules-based systematic strategy, and we rebalance once a year.

So we rebalance after the human rights and economic freedom data comes out in December. The third Friday in January is our rebalance date. So we’re going up towards that rebalance date now because Taiwan has so outperformed this year, its starting allocation at the beginning of the year was 22%, and now it’s grown to 30%. So that’s due to market performance, not my target allocation. So the target allocation was 22 and it was the freest country in this space.

So yes, sometimes that happens. This happened with Chile a couple of years back. This is a great problem to have. But at the end of the year, it does make me very nervous. But that because I come from the school of thought that you share, which is we want higher diversification, lower concentration, but in this case I’m okay with it because it’s due to outperformance and it’s due to having a better outcome for our investors. So I’m looking forward to that rebalance though.

Taylor Schulte: I think we touched on this five years ago when you were on the show, but why are you so invested in this? Why have you committed your career to not only educating investors about the Freedom Index and investing in freer countries, but launching this ETF? Why are you so invested in this topic?

Perth Tolle: I grew up in both China and the us. I was born in Beijing and I lived there until I was nine, and then I went back to live in Hong Kong after college. So I had exposure to both countries, US and China, and then Hong Kong, which is at the time I was there in 2003 and 2004, a very different place than it is now.

And I saw the difference in these markets, and I could tell that freedom is what made that difference as freedom made the difference in my life as well growing up in the US versus China. And so I was also born in the year that the one-child policy in China was instituted. And my generation is completely different now than I think it would’ve been if that had not happened. And that’s one of the examples of extreme government overreach in China where you’re told help literally, you can only have one child now that has gone up to two and then three children.

But as you can see, no one is having two or three children because the entire culture of my generation changed with that policy. People in China, the young people now are even not having children as a form of protest because the government. So this is something that resonated with me personally, but also my time as an advisor.

I was an advisor for 10 years after Fidelity before doing this, and I had clients. I was in the LA and Houston markets, a lot of non-US clients, and I had a Russian client, for example, that told me, Hey, I don’t want to invest in Russia because it’s like funding terrorism. That turned out to be very prescient, but I felt the same way about China. So I wanted to create a way for investors who felt like we did to be able to invest in emerging markets because I do want that diversification and I see that as being very beneficial in the long run for investors potentially.

So I wanted a way to get that allocation without lending autocracies, and I wanted to also give the freer countries a little bit higher weight just because I think those are the best places to find those next big growth stories which are going to make a difference in the outcomes for investors. That’s where I got the seed for the idea. And then as I was working at Fidelity, I saw the growth of indexing and ETFs, saw the benefits of ETFs for investors and created this product to take advantage of that.

Taylor Schulte: Yeah, I appreciate you sharing that. And again, the fund is growing significantly. It’s coming up here on a billion dollars of assets under management, so you’ve had a lot of success in a short period of time. Not only that, and this may be partly the reason for the success, the fund has done very well over the last five and a half years since inception. It’s outperformed those market cap-weighted funds that we’ve referenced pretty significantly.

I’ll share some more specific numbers in the intro to today’s episode, but I’m curious, as we round this episode out here episode, what’s changed, if anything, with the freedom weighted index since you joined me five years or since inception? Have you made any changes to the index, any improvements, any rule changes, and then any expected future changes in the coming years?

Perth Tolle: The index committee meets mid-year to discuss, do we want to make any changes to the index since a five-year inception date, we haven’t had any significant changes that have caused any prospectus alerts or anything like that. It’s only been small tweaks, but what we have done is, I don’t know if we had this five years ago, so I’ll just tell you some of the little tweaks that we made. So there’s buffer rules.

Now we include the top 10 largest, most liquid companies in the index that are not state-owned, so largest 10 in the country that’s represented. So sometimes those will fall to number 11, and we don’t want to be selling just because it fell one unit in the R. So to avoid unnecessary turnover, we have a buffer rule that they have to follow to below 12 to be dropped basically, because we don’t want to be dropping those companies right at the wrong time when their price is low.

And also that’s to avoid the unnecessary turnover, like I said. So we have those buffer rules in place that I don’t believe was in the very beginning. We’ve always had the freedom, momentum decline rule, which is if a country that is included drops more than five points on the freedom house scale in that year, the measurement year, then it is excluded from the index.

The only country that ever triggered that rule was Turkey, and that was before fund inception. That was 2018. The fund was incept in 2019 and Turkey never made it back in. Other than that, I don’t believe we’ve had any significant changes. We have a 8% cap on securities because for example, TSMC and Samsung would be like 50% of their respective markets if we don’t cap it at 8%. That way it doesn’t become too overly concentrated in those top stocks.

We may at some point because of situations like we’re seeing right now, add a buffer on the country weight. So maybe if a country becomes more than a certain weight, we will go back to target weights midyear. But we haven’t done that yet because so far I don’t see that helping investors because sometimes it just needs to keep running

Taylor Schulte: The momentum.

Perth Tolle: So I don’t like to place a lot of artificial constraints on what’s happening naturally within the index. I don’t like to do subjective judgment calls. That’s why with the strategy, we don’t make a subjective call as to who’s included, who’s excluded. The algorithm does that naturally, and it just depends on how the scores fall. If it scores above average, it’s included basically.

And I’m not making that call or drawing that line in the sand. I like to get rid of all subjectivity, be as objective as possible, let the index do its thing. It’s worked so far. So I’m grateful for that, and I’m grateful for the way that the market responded to it. And for all of you guys who invest in it, I wouldn’t expect this stark outperformance every year when you tell people the numbers for the last five years, it’s a very stark outperformance.

We had some very extreme events, Covid, the war. We also had some very good performance in the freer markets. This is designed to be outperforming in the long run, definitely, potentially, but I wouldn’t buy it just for performance alone. So there’s two types of investors that we have.

One that says, I think for your countries will outperform, and one that says, I don’t want to funnel money to autocracies through my emerging markets allocation. And some people are both. I’m both. But yeah, I wouldn’t buy it for performance alone or to juice the performance of your emerging markets portfolio. It is designed to perform somewhat in line with benchmarks, but we do believe in the outperformance potential over time.

Taylor Schulte: Well, Perth, I really appreciate you coming back on the show. I wish we didn’t wait five and a half years to have this conversation, this follow up conversation. Congratulations on all the success that you have had. I can’t wait until you cross that billion dollar mark before we part ways here, where can people find you if they want to learn more about you or the strategy?

Perth Tolle: Yeah, so the strategy can be found on freedometfs.com. The index is lifeandlibertyindexes.com, and I am on LinkedIn and Twitter, less active on Twitter than I was five years ago. I think that’s a big change. But yeah, no, that’s where you’ll find me.

Taylor Schulte: Awesome. Thanks so much, Perth.

Perth Tolle: Thanks so much.

Episode Disclaimer: This podcast is for informational and entertainment purposes only and should not be relied upon as a basis for investment decisions. This podcast is not engaged in rendering legal, financial, or other professional services.