Today, I’m continuing our series on Small Cap Value investing.

Specifically, in part two, I’m addressing three BIG questions:

- How do small-cap value stocks reduce risk and improve returns

- What criteria does an investment need to meet to be included in a portfolio

- Why is value investing still alive and well

While there is no shortage of research in favor of this dominant asset class, I’m also sharing why investors don’t necessarily need small-cap value stocks to reach their retirement goals.

Listen To This Episode On:

When You’re Ready, Here Are 3 Ways I Can Help You:

- Get Your FREE Retirement & Tax Analysis. Learn how to improve retirement success + lower taxes.

- Listen to the Stay Wealthy Retirement Show. An Apple Top 50 investing podcast.

- Check Out the Retirement Podcast Network. A safe place to get accurate information.

+ Episode Resources

- Stay Wealthy Episodes Referenced:

- Small Cap Value

- It’s Too Soon to Say the Value Premium Is Dead [Morningstar]

- Value Is Dead, Long Live Value [OSAM]

- What Are Small Cap Stocks [Investopedia]

- Dimensional Fund Advisors

+ Episode Charts

Source: Returns Web – Performance data shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Average annual total returns include reinvestment of dividends and capital gains. To obtain Dimensional Fund performance data current to the most recent month-end access our website at www.dimensional.com. See Standardized Performance Data and Disclosures. Performance for periods greater than one year are annualized unless specified otherwise. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associate with the management of an actual portfolio. Prior to listing date the following ETFs operated as mutual funds: DFUS, DFAC, DFAS, DFAT listing date 6/14/21; DFAX, DFIV listing date 9/13/21; and DFUV listing date 5/9/22. The NAVs of the predecessor mutual funds are used for both NAV and market price performance from inception to listing.

Source: Returns Web – Performance data shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Average annual total returns include reinvestment of dividends and capital gains. To obtain Dimensional Fund performance data current to the most recent month-end access our website at www.dimensional.com. See Standardized Performance Data and Disclosures. Performance for periods greater than one year are annualized unless specified otherwise. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associate with the management of an actual portfolio. Prior to listing date the following ETFs operated as mutual funds: DFUS, DFAC, DFAS, DFAT listing date 6/14/21; DFAX, DFIV listing date 9/13/21; and DFUV listing date 5/9/22. The NAVs of the predecessor mutual funds are used for both NAV and market price performance from inception to listing.

+ Episode Transcript

Small Cap Value (Part 2): How to Reduce Risk and Improve Returns

This show is a proud member of the Retirement Podcast Network.

Taylor Schulte: Welcome to the Stay Wealthy Podcast. I’m your host, Taylor Schulte, and today I’m continuing our small-cap value investing series. Here in part two, I’m sharing three important things.

Number one, how these risky small-cap value stocks can actually reduce volatility.

Number two, what criteria an investment needs to meet to be included in a portfolio?

And number three, why value investing probably isn’t dead.

While there is no shortage of research in favor of this dominant asset class, I’m also sharing why investors don’t necessarily need small-cap value stocks to reach their goals.

To view the research, articles and charts supporting today’s episode, just head over to youstaywealthy.com/226.

Let’s quickly review two key points from the last episode.

First, investing in smaller, less-known companies is riskier than investing in larger, more established companies. Small companies are more volatile and typically experience larger losses during catastrophic market events. But investors willing to accept these risks have been rewarded with higher long-term returns.

Second, value stocks are often defined as unpopular or even struggling companies that are trading at a bargain price. The market has historically rewarded investors for buying these unloved companies by providing them with higher returns. But those higher returns don’t show up every year.

Returns are lumpy and value stocks are not immune to periods of underperformance. That’s the biggest risk value investors are faced with. Without patience and discipline and conviction, an investor may never reap the benefits of value investing.

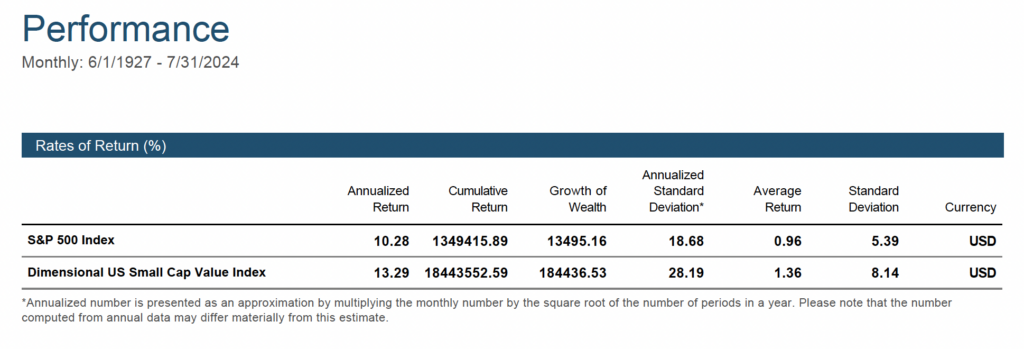

We can sum this all up by saying that investing in small-cap stocks, trading at bargain prices, is riskier than investing in large-cap stocks tracking the S&P 500. But that additional risk has rewarded investors with higher long-term returns. More specifically, since 1927, the S&P 500 has had an average annual return of 10.3%.

On the other hand, small-cap value stocks have had an average annual rate of return of 13.3%, an outperformance of 3% per year on average.

Now, while that extra 3% sounds appealing and looks good on paper, many investors, and maybe many of our listeners, especially those who are retired or close to it, might conclude that the extra risk is not necessary, that a 10% average annual return for their stock portfolio is more than sufficient for reaching their retirement goals, that they don’t need to take more risk just to earn a little more return.

But what if I told you that including small-cap value stocks in a portfolio could actually reduce risk and volatility without sacrificing returns?

In other words, what if small-cap value stocks could help an investor achieve the same 10% average annual return with less risk and volatility than the S&P 500?

Enter the benefits of diversification.

As we’ve discussed a number of times here on the show, we have to be careful about evaluating asset classes in isolation. It’s quite rare for an investor to put all of their eggs in one basket, i.e. invest in just one single asset class. Most investors don’t just own stocks. At the very least, they typically also own some percentage of bonds. And when you evaluate the construction of a diversified portfolio of stocks and bonds, the story around small-cap value stocks being riskier than large-cap stocks begins to shift.

Let me explain. As I just shared a minute ago, the S&P 500 has had an average annual return of 10.3% since 1927. The annualized standard deviation of the S&P 500 during this 97-year time period was approximately 19.

Now, for the sake of today’s conversation, all you really need to know about the standard deviation is that it helps determine the risk of an investment, that the higher the standard deviation is, the higher the risk.

So, since 1927, the S&P 500 has had a 10.3% average annual return and an annualized standard deviation of 19. During the same time period, small-cap value stocks, as measured by the dimensional US Small Value Index, has had an average annual return of 13.3% and a standard deviation of 28.

Not terribly surprising, right? Higher risk than the S&P 500, 28 versus 19, and a higher return, 13.3% versus 10.3%. The goal of diversification, in addition to mitigating the chances of catastrophic losses, is to improve or optimize the risk return profile of a portfolio.

In other words, diversification, if implemented properly, can help reduce risk without necessarily sacrificing long-term returns.

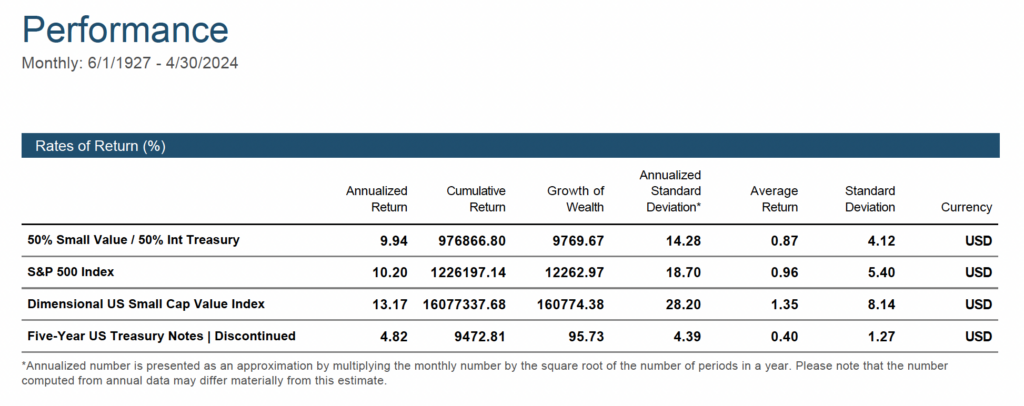

So, going back to my original question, what if I told you that you could have achieved the same 10% average annual return as the S&P 500 with less risk and less volatility?

Well, one way to accomplish this, at least historically, is through a combination of small-cap value stocks and plain vanilla intermediate treasury bonds. Looking at that same time period since 1927, a portfolio comprised of 50% small-cap value stocks and 50% intermediate treasury bonds has had an average annual return of 10% and, drum roll please, an annualized standard deviation of 14.

The same 10% average return as the S&P 500, but with 25% less risk.

In other words, one could argue that putting everything in the S&P 500 for the last 97 years was actually riskier than a simple 50-50 portfolio split between risky small-cap value stocks and plain vanilla treasury bonds.

Now, while it’s an eye-opening exercise and a fun statistic to share, I think most of us are likely in agreement that just investing in two asset classes, even with that sort of attractive risk return profile, is not prudent, especially when we’re in retirement and we need to rely on consistent portfolio withdrawals to fund living expenses for 30 or 40 years.

As I’ve already highlighted, and as we’ve witnessed in recent years, asset class returns are lumpy small-cap value stocks can go through periods of underperformance. So can treasury bonds, so can US and international stocks. And that’s precisely why diversification is so important.

In addition to protecting your portfolio from catastrophic losses, diversification also enables investors to dial the risk-reward profile up and down to meet their specific and unique retirement needs and goals.

The question should not be, are small-cap value stocks a better investment than the S&P 500? The question or questions should be, one, what asset classes have robust evidence to support that they belong in a diversified portfolio?

And then two, what percentage of each of those asset classes should I allocate to in my portfolio to optimize for my desired risk-return profile?

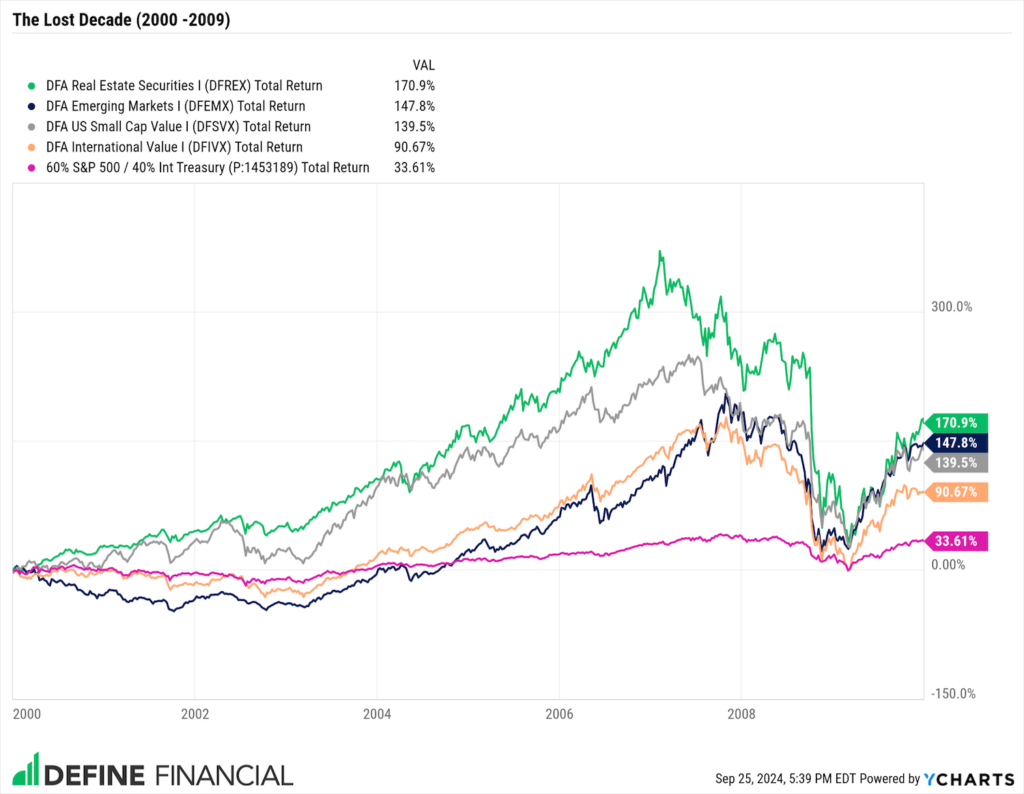

A simple low-cost 60-40 portfolio invested in the S&P 500 and intermediate treasury bonds sounds like a nicely diversified smart portfolio until you look at a period like the last decade where that portfolio barely squeezed out an average annual return of 3%.

While it’s of course possible that we never see a repeat of that decade ever again, my personal view is that excluding asset classes like small-cap value from a portfolio and others that have evidence to support their inclusion, excluding these asset classes is riskier than including them, especially for those in retirement taking withdrawals from their portfolio.

Now, while you may agree with me and you may find the long-term historical research compelling, it’s possible that many listeners and many investors are still struggling with the last two decades and the significant underperformance of small-cap value stocks.

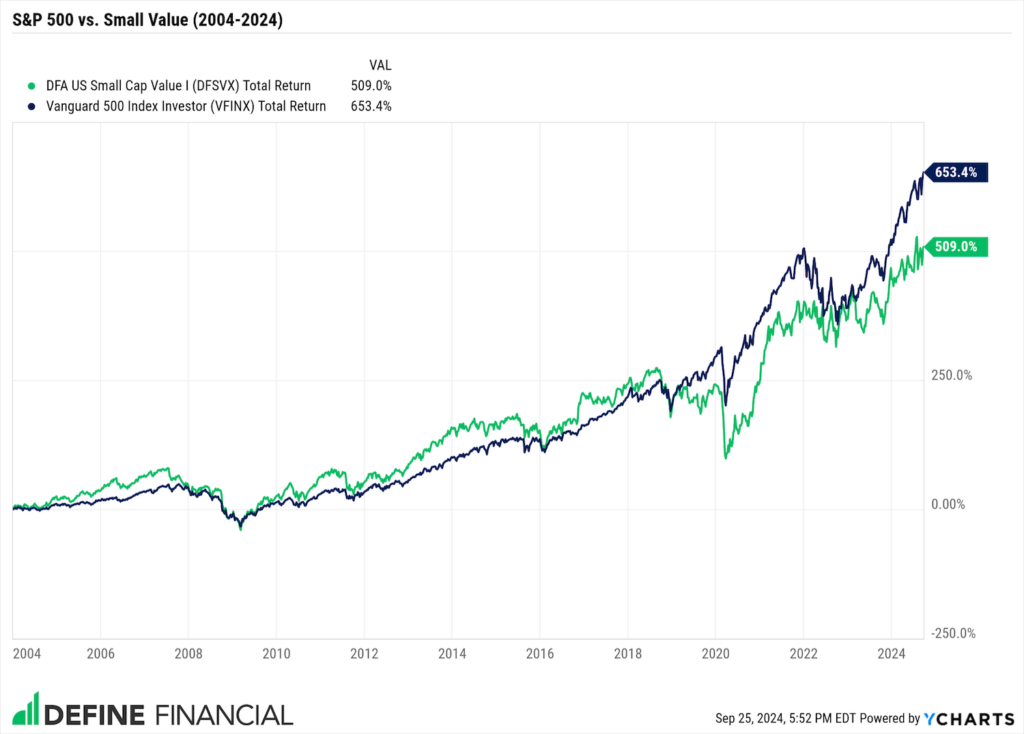

As I shared in part one of this series, since 2004, the Dimensional US small-cap Value Fund, this is one of the oldest and most established funds in this category, this fund has underperformed the S&P 500 by over 100% since 2004.

20 years, two decades, that is not an insignificant data point to ignore, and it certainly raises valid questions about this asset class. In last week’s episode, I shared a clip from prior guest, Reuben Miller, who provided a very logical response to the increasingly popular question, is small-cap value investing dead?

And while I love and agree with his answer and think it sufficiently answers the question, I want to quickly address it from another angle. And that is by highlighting just how delicate these back tests can be.

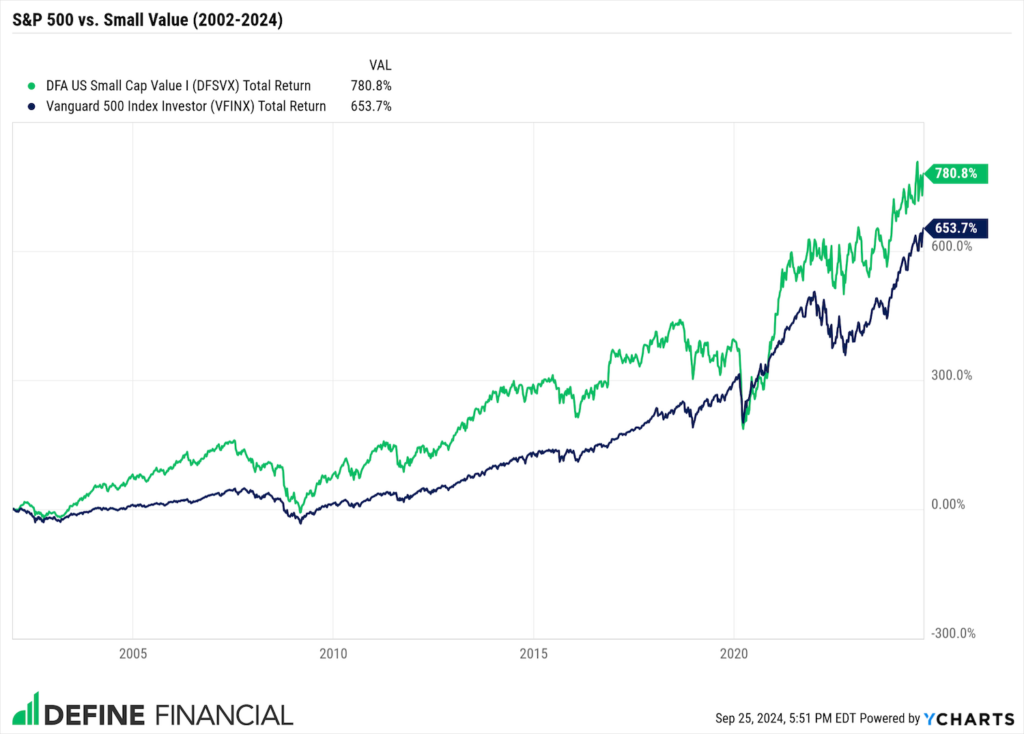

For example, as I just mentioned, the dimensional US small-cap value fund has underperformed the S&P 500 by over 100% over the last 20 years. But if we expand our data set by just one year and look at the last 21 years instead of the last 20 years, the results flip. Specifically, since 2003, the dimensional small-cap value fund outperformed the Vanguard S&P 500 by about 6%.

But wait, there’s more.

If we expand our data set by just one more year and evaluate the performance from 2002, a 22 year time period, we’ll find that the small-cap value fund has now outperformed by 130%. So if an investor or media outlet evaluates the last 20 years because it’s a nice round number, it would appear that small-cap value is a horrible asset class to own.

But if the investor expands the data set by just 24 months and chooses to evaluate the last 22 years instead, it looks like small-cap value stocks are a no brainer.

Historical performance can be helpful and constructive and even entertaining, but it can’t and should not be the only measure used to determine if an asset class belongs in a long-term retirement portfolio, especially when evaluated over short time frames.

In part one of the series, I shared the four primary drivers of equity returns. These drivers are also commonly referred to as premiums, the market premium, the size premium, the value premium and the profitability premium.

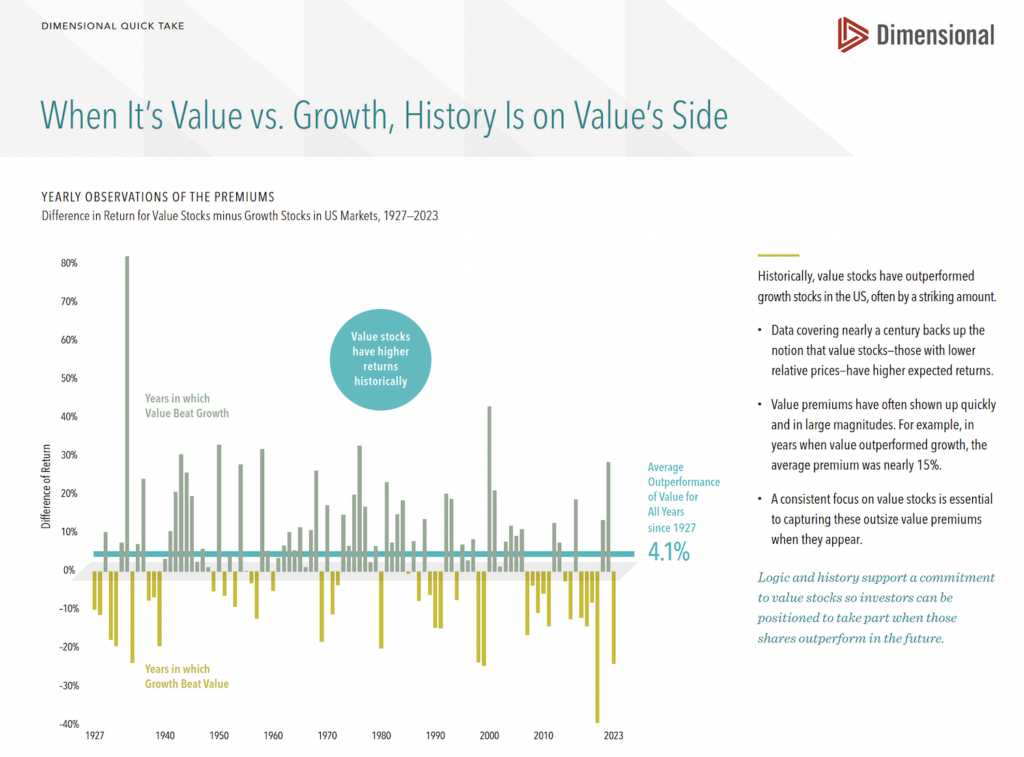

Academic research suggests that we should expect these four premiums to be positive over long periods of time, that stocks should outperform bonds, that small-caps should outperform large caps, that value should outperform growth, and high profitability companies should outperform low-profitability companies.

But these drivers or premiums weren’t just born out of thin air. They were rigorously tested to meet certain standards before being adopted by the academic investing community and used to influence the construction of a portfolio.

Long-term historical data is one of these standards and is more specifically referred to as a positive premium being persistent, that a driver of return needs to be persistent and validated by historical data over a long period of time.

In other words, if stocks outperforming bonds was deemed to be a coin toss over long periods, it wouldn’t be considered persistent. In addition, a reliable driver of return needs to be sensible and supported by logic.

For example, is it sensible and logical to confidently conclude that Bitcoin will continue to have positive expected returns without any claim on future cash flows like a stock dividend or bond interest payment? A premium also needs to be pervasive across sectors, countries and time periods. If the positive premium only shows up in the large-cap US stock market and nowhere else, it would fail to meet this test.

The premium also needs to be robust, i.e. the results should be positive under a variety of conditions.

And finally, one that we can all likely wrap our heads around, it needs to be cost-effective. As noted by Brad Steinman at Dimensional, quote, while a positive premium is never guaranteed, the odds of realizing one are decidedly in your favor and improve the longer you stay invested.

As it relates to value stocks or the value premium, the odds are not in your favor over long periods because the positive premium just shows up a little bit each month or each year. The odds are in your favor over long periods of time because when the value premium shows up, it really shows up. It appears quickly and in large magnitudes.

For example, since 1927, in years when US value stocks outperformed growth, the average premium or average outperformance was nearly 15%. Not the average across all years, the average across the years in which value stocks outperformed growth, the years we experienced a positive value premium.

With that in mind, it should be obvious now that if you missed just a few of those years because you were a one foot in, one foot out type of value investor, you can likely wave goodbye to any meaningful long-term outperformance from that driver of return. As noted at the top of today’s show, that’s the biggest risk value investors are faced with.

Without patience and discipline and conviction in this philosophy, or this specific driver of return, an investor may never reap the benefits of value investing.

Look, at the end of the day, nobody has a crystal ball. It’s certainly possible that in the year 2004, the value premium died, that value stocks have underperformed since 2004, and that the trend will continue for the next 20 years and beyond. We cannot assign a probability of zero to that scenario.

I don’t want anyone to think that I’ve consumed enough of the value premium Kool-Aid to believe that it’s guaranteed to persist into the future forever.

My goal in constructing portfolios is to use evidence and research to stack the odds in my and my clients’ favor over long periods of time without putting the portfolio at risk of catastrophic losses. To optimize the portfolio and take an appropriate amount of risk to achieve the returns needed to reach their retirement needs and goals.

I believe based on strong evidence and research that a healthy allocation to small-cap value stocks in a globally diversified portfolio enables me to best accomplish that. But you or your advisor may not. And that’s OK.

As shown today, there are multiple ways to achieve different goals and different desired rates of return. There is no one-size-fits-all solution. Excluding this asset class from your low-cost, globally diversified portfolio likely won’t put your plan in jeopardy. Remember the best investment or best philosophy is the one you can stick with.

But if you think that including small-cap value stocks in your portfolio is fitting and better helps you reach your investment and retirement goals and is a philosophy that you think you can stick with for long periods of time, I’m sharing a bonus part three of this series episode next week where I’m breaking down how to take action and invest in this asset class because unfortunately, it’s just not as simple as searching for the lowest cost small-cap value fund.

Once again, to grab the links and charts and resources mentioned in today’s episode, just head over to youstaywealthy.com/226.

That’s youstaywealthy.com/226.

Episode Disclaimer: This podcast is for informational and entertainment purposes only and should not be relied upon as a basis for investment decisions. This podcast is not engaged in rendering legal, financial, or other professional services.