Today, I’m sharing why Indexed Universal Life (IUL) is a bad investment.

On the surface, IUL appears to offer attractive investment returns, guarantees, and tax benefits.

However, it typically falls short compared to traditional options and is not suitable for most retirement savers.

In fact, that’s exactly what I found when I bought an Indexed Universal Life insurance policy!

I read the fine print, did the math, and uncovered the ugly truth.

If you want to learn the most common lies told by IUL agents and why this insurance product is a bad investment, you’re going to love this comprehensive guide.

Key Takeaways

- IUL policies may seem attractive but have hidden complexities and high fees.

- Tax benefits and market returns with IULs are limited compared to alternatives.

- Carefully consider your options before choosing an IUL (or whole life insurance) over term life insurance.

- IUL policies are often misrepresented as investments rather than insurance products.

- The promised returns of IUL policies typically underperform traditional index fund investments.

How Indexed Universal Life Insurance (IUL) Works

Indexed Universal Life (IUL) insurance is a type of permanent life insurance that combines traditional universal life insurance with an investment component.

Just like traditional life insurance, you pay recurring premiums to own and maintain an IUL policy.

A portion of your premiums covers the policy’s death benefit, and the remaining portion is allocated to a cash value savings account, which is invested in a market index (e.g., the S&P 500).

The performance of the chosen market index determines the growth of your cash value account. If the index performs well, your cash value account has the potential to increase.

While there are downsides to understand, you can borrow from your cash value account or use it to pay policy premiums.

The sales pitch for IUL policies typically emphasizes the following:

- Protection against market downturns with a “floor” on losses

- Potential for attractive investment returns

- Tax-free growth and tax-free withdrawals

- Ability to “be your own bank” by borrowing against the policy

While the pitch is compelling, IUL policies are far more complex and much less favorable than the sales pitch suggests.

For example, your investment gains are not directly tied to the stock market.

Instead, your gains are typically subject to a participation rate, interest rate cap, or both.

These factors can limit the growth potential of your cash value account compared to directly investing in the market through a low-cost index fund.

Although IUL policies can offer flexibility in premium payments and the potential for upside market participation, they contain numerous risks and drawbacks.

Before deciding, make sure to clearly understand the policy’s terms and conditions, as IUL policies can be complex and unsuitable for most people.

The Complexity of IUL Policies: What They Don’t Tell You

Indexed Universal Life Insurance (IUL) policies are often marketed as simple investment vehicles, but the reality is far more complex.

These policies come with a labyrinth of terms and conditions that are challenging to navigate.

For example, when you purchase an IUL policy, you’ll encounter a variety of fees that may not be immediately apparent:

- Administrative fees

- Cost of insurance fees

- Premium expense fees

- Surrender fees

In addition, the way your cash value grows in an IUL policy is tied to market indexes, but it’s not as straightforward as it seems.

Your returns are subject to:

- Participation rates

- Caps on gains

- Floors on losses

These factors can significantly impact your potential returns, often in ways that are difficult to predict or understand without extensive financial knowledge.

IUL policies offer “flexible premiums,” which may sound attractive, but they can be a double-edged sword.

For example, if the policy underperforms, you could be required to pay higher premiums to keep it active.

Lastly, the cash value component of IULs is often touted as a retirement planning tool. However, accessing this cash value through loans can be tricky.

If not managed carefully, these loans can:

- Reduce your death benefit

- Potentially cause the policy to lapse

- Create unexpected tax liabilities

Understanding how IUL fits into your financial plan requires careful consideration. The complexity of these policies means you could easily misunderstand key features or overlook important details.

10 Reasons Why IUL is a Bad Investment

IUL insurance agents tell a very compelling story—I know because I met with one and purchased a policy!

To help you learn from my experience and avoid making a mistake, here are 10 reasons why IUL is a bad investment.

1.) Dividends Are Excluded From Performance

An IUL sales pitch often compares a policy’s historical performance to the S&P 500 index without including dividends.

This misrepresentation makes the IUL appear more competitive than it actually is.

When dividends are factored in, the S&P 500’s true performance is significantly higher than Indexed Universal Life Insurance.

2.) Cherry-Picked Timeframes

When showing historical performance, it’s common for insurance agents to use time periods that make IUL policies look the most attractive.

For example, they may focus on periods of high market volatility or poor stock market performance to showcase the policy’s downside protection.

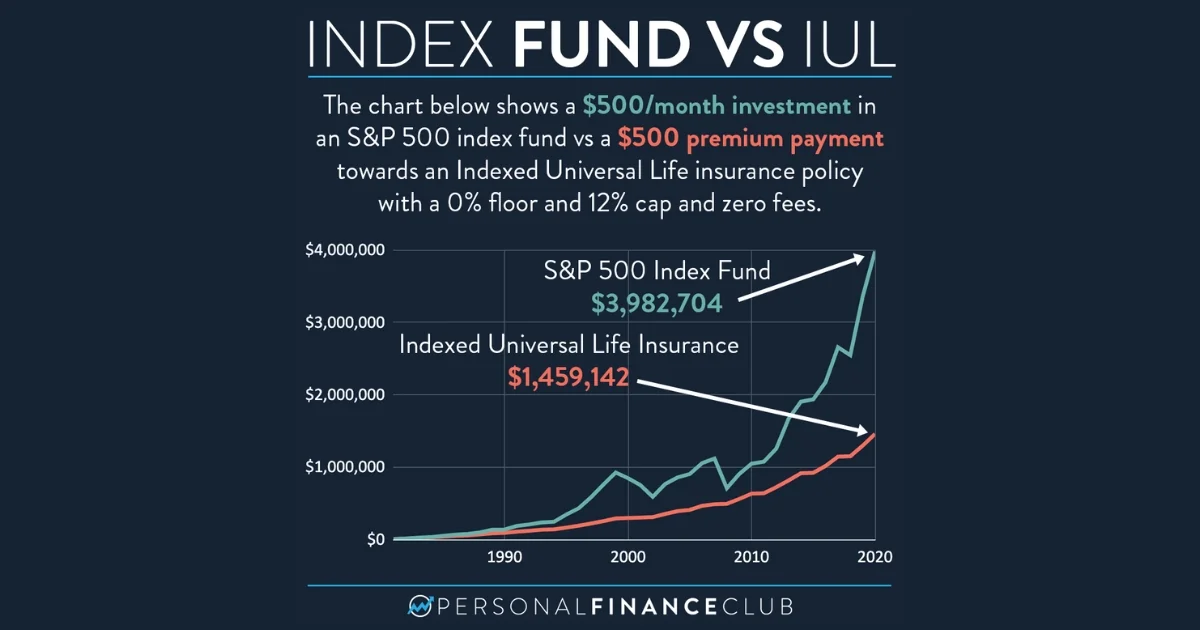

However, over longer time horizons, low-cost U.S. stock index funds have outperformed IUL policies.

3.) Hidden Fees

IUL policies come with numerous fees that are often glossed over during the sales pitch.

These can include:

- Premium expense charges (e.g., 6% of each premium payment)

- Monthly policy fees

- Per-unit charges based on the death benefit

- Surrender charges for early policy termination

- Index account charges (similar to expense ratios in mutual funds)

These fees can significantly eat into the policy’s cash value and overall returns.

4.) High Insurance Costs

In addition to the other fees, policyholders must pay for the actual life insurance coverage. This cost of the insurance increases as you age, eroding the cash value over time.

If you need permanent insurance, you’ll need to accept the increasing costs as you get older. If you don’t need (or want) permanent insurance, then you should not buy an IUL.

5.) Poor Investment Performance

Despite claims of market-beating performance, IUL policies typically underperform low-cost index funds over the long term. This is due to the combination of fees, caps on investment gains, and the policies’ complex structure.

With low-cost index funds, you are just paying for the management cost (i.e., expense ratio) of your chosen investment. With an IUL policy, you’re paying for the cost of the investment AND the cost of insurance.

Given the extra layer of cost, it shouldn’t be a surprise that IUL underperforms traditional investments.

6.) Exaggerated Tax Benefits

While IUL policies do offer some tax advantages, these benefits are often overstated.

For example, the tax-free death benefit that is often highlighted is a feature of all life insurance policies, not just IULs.

Additionally, the ability to borrow against the policy tax-free is similar to other types of loans available to investors. There is no free lunch—these loans come with additional risks and costs.

7.) Misleading Claims About Wealthy Investors

Insurance agents often claim that wealthy individuals heavily invest in IUL policies. However, this is largely a myth.

Most successful people build their wealth through business ownership, real estate, and low-cost index funds.

The reason some ultra-wealthy people buy permanent life insurance policies is to help their heirs pay the large estate tax bill when they eventually pass.

Unless your estate is worth over $12.29 million (or $24.58 million for married couples), you can skip permanent insurance policies like Indexed Universal Life.

8.) The “Infinite Banking” Myth

The concept of “being your own bank” by borrowing against your IUL policy is often touted as a major benefit.

However, this strategy comes with fees and risks, and the underlying cash value typically grows much slower than a traditional investment portfolio.

Want to be your own bank?

Make more money, save more money, and skip buying expensive investment and insurance products. With a healthy financial plan and a healthy cash reserve, you’ll have a thriving bank to “borrow” from whenever you need.

9.) “You’re Doing It Wrong” Argument

When faced with criticism, some insurance agents claim that the policy wasn’t “properly structured.” However, the fundamental issues with IULs remain regardless of how they’re set up.

An IUL policy combines the benefits of permanent life insurance with an investment product. Since 99.9% of people don’t need permanent life insurance, nobody is “doing it wrong” except the salesperson.

The insurance company’s role as a middleman packaging up a product that most people don’t need is exactly why IUL is a bad investment.

10.) Additional Unfavorable Terms

IUL policies have some attractive features, but the unfavorable terms are not typically explained in detail. These terms include:

- Withdrawal fees

- Delays in accessing your cash value

- The ability of the insurance company to change fees and performance caps at their discretion

- Loss of cash value upon death (only the death benefit is paid out)

If you have determined that you need life insurance, here’s what to do instead of buying Indexed Universal Life:

- Evaluate how much insurance you need

- Consider term life insurance, which is much cheaper than IUL policies

- Invest the money you saved into low-cost index funds

By separating your insurance needs from your investment strategy, you can achieve better protection and higher returns while maintaining greater control over your finances.

Important Questions to Ask Before Purchasing IUL

Considering an IUL policy? Here are the most important questions you need to ask before purchasing:

- How are the premiums structured? – Understand whether premiums are flexible and how they can change over time.

- What are the stock market index options for growth? – Ask which stock market indices the policy is tied to and how they impact cash value growth.

- What is the cap and participation rate? – Know the maximum returns (cap) and the percentage of index growth you’ll receive (participation rate).

- What is the guaranteed interest rate? – Identify the minimum interest rate in case the index performs poorly.

- How flexible are premium payments? – Understand if and how you can adjust premiums over time.

- What are the fees and charges? – Ask about mortality charges, administrative fees, surrender fees, and other costs that might eat away at the benefits of the policy.

- Can loans or withdrawals be taken against the policy? – Clarify terms for accessing the cash value via loans or withdrawals.

- What are the tax implications? – Understand how the policy impacts your taxes, both for the cash value and the death benefit.

- How will changes in interest rates or the market affect my policy? – Know how market fluctuations and interest rate changes impact the performance and sustainability of the policy.

Clear answers to these questions will help you understand the features, risks, and benefits of an IUL policy before committing.

Frequently Asked Questions

While rare, there may be specific situations where an IUL policy could be beneficial, such as for high-net-worth individuals with complex estate planning needs. However, for the vast majority of people, separating insurance and investments is a more effective strategy.

Be wary of agents who downplay fees, use overly optimistic return projections, or pressure you to make a quick decision. Always ask for a full illustration of the policy, including all fees and charges, and seek a second opinion from a fee-only financial advisor.

Review your policy carefully, including all fees and projected returns. Consider consulting with a fee-only financial advisor to evaluate whether keeping the policy or exploring alternatives would be more beneficial for your specific situation.

Fees associated with Indexed Universal Life (IUL) insurance policies can be quite high. They typically include administration fees, mortality costs, and surrender charges, among others. The exact fees depend on the policy and issuer, so make sure you understand them when considering an IUL. The lack of transparency is one of the reasons many consider IUL a bad investment.

When comparing IUL to a Roth IRA, it’s essential to understand the difference between investment and insurance products. IUL is a permanent life insurance policy that combines a death benefit with a cash value component tied to an investment index (e.g., S&P 500). In contrast, a Roth IRA is a retirement savings vehicle that allows tax-free growth. It also allows tax-free withdrawals as long as certain rules are met. Roth IRAs provide more transparency, flexibility, and lower fees, making them a more straightforward choice for retirement savings than Indexed Universal Life insurance.

IULs offer a few benefits, such as tax-free growth, permanent life insurance coverage, and some flexibility with premium payments. However, they also have significant drawbacks, including high fees, limited investment potential, and a lack of transparency. Most financial experts do not recommend IUL policies, given these factors.

Several insurance companies offer IUL policies, including well-known providers like Prudential, Transamerica, and Pacific Life. Keep in mind, however, that companies may offer various policies with different features, fees, and potential returns. Always research and compare options before purchasing an IUL policy.

While the interest credited to the cash value component of an IUL is tied to an index, most policies include a guaranteed minimum interest rate, which somewhat protects policyholders from index declines. However, the overall success of an IUL policy depends on its specific terms, fees, and performance, so losing money is still possible, especially if the cash value component does not grow enough to offset fees and costs.

Unlike qualified retirement accounts like IRAs or 401(k)s, IUL policies do not have annual contribution limits. Instead, the premiums are based on factors such as the death benefit, your age, and health. However, excessive policy premiums could lead to a policy becoming classified as a Modified Endowment Contract (MEC) by the IRS, which may result in tax implications on policy loans and withdrawals. Make sure to consult an insurance agent or financial advisor to ensure your IUL policy remains in a non-MEC status.

🎙️ Podcast: Why You Should Avoid Indexed Universal Life Insurance

Want to continue learning about Indexed Universal Life Insurance (IUL) policies?

In this podcast episode, I share the top reasons why you should avoid IUL by exposing the exact lies I was told when I bought a policy.👇

When You’re Ready, Here Are 3 Ways I Can Help You:

- Get Your FREE Retirement & Tax Analysis. Learn how to improve retirement success + lower taxes.

- Listen to the Stay Wealthy Retirement Show. An Apple Top 50 investing podcast.

- Check Out the Retirement Podcast Network. A safe place to get accurate information.