Today I’m discussing the biggest retirement investment risk.

As Morgan Housel put it:

“It’s the hardest risk for people to understand, and it’s the only one that really matters.”

In this episode, you’ll learn:

- What the three sides of risk are

- Why tail risk is all that matters

- How to mitigate this risk in your retirement plan

You’ll also learn why most investors should (probably) stay away from investment products promising you lots of upside with limited downside.

Listen To This Episode On:

When You’re Ready, Here Are 3 Ways I Can Help You:

- Get Your FREE Retirement & Tax Analysis. Learn how to improve retirement success + lower taxes.

- Listen to the Stay Wealthy Retirement Show. An Apple Top 50 investing podcast.

- Check Out the Retirement Podcast Network. A safe place to get accurate information.

+ Episode Charts

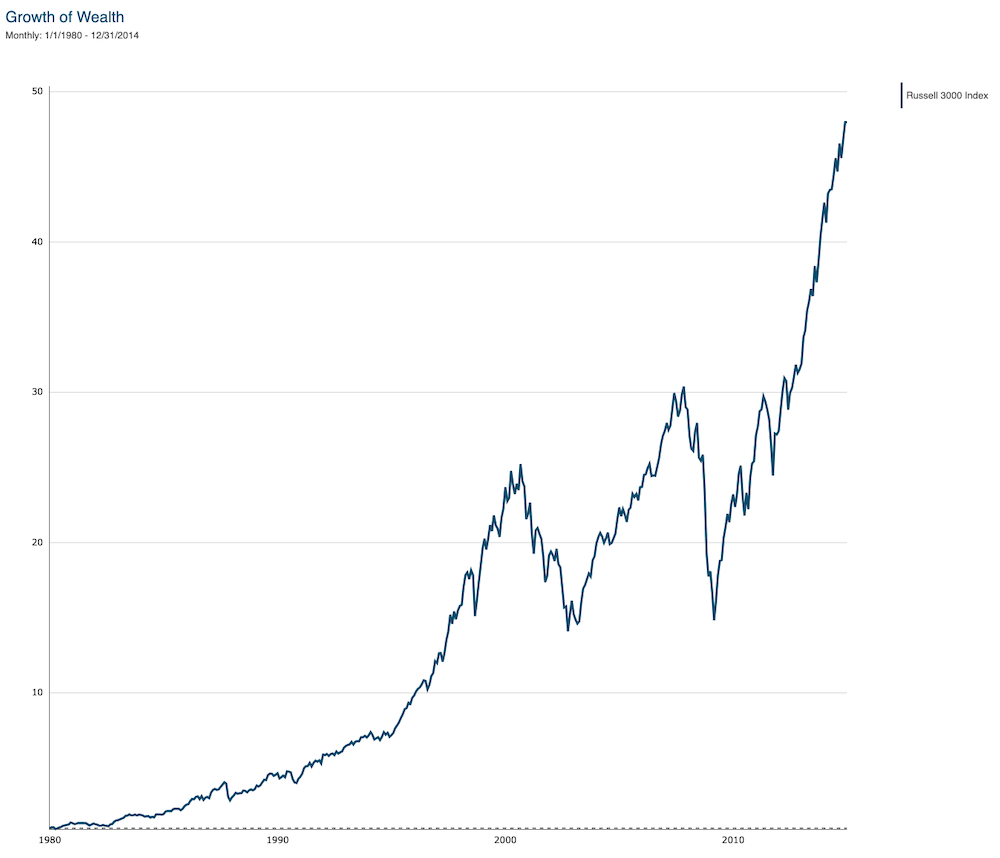

DFA Returns: Russell 3000 Index (1980 – 2014)

+ Episode Resources

+ Episode Transcript

Taylor Schulte: Our annual family ski trip is right around the corner.

With an average temp of 65 degrees in San Diego and over 260 days of sunshine each year, going to the snow is a pretty big deal for us.

So much so that our kids have been counting down the days since last year’s trip ended. Just four more sleeps, my six-year-old told me on our morning walk yesterday.

While all he’s thinking about is how much faster he’s going to go down the mountain this year, all I’ve been thinking about is I hope nobody gets hurt.

Five years ago, Morgan Housel published a personal, tragic story about what skiing taught him about risk and investing. I’ve read it countless times and I think about it every winter when I’m headed to the mountains.

This year is no exception.

Welcome to The Stay Wealthy Podcast. I’m your host, Taylor Schulte, and today I’m sharing Morgan’s story and using it as an opportunity to talk about risk. Not just any risk but arguably the most difficult form of risk for investors to understand and the only one that really matters.

To view the articles and research supporting today’s episode, just head over to youstaywealthy.com/237.

The Biggest Retirement Investment Risk: How to Protect Your Portfolio

Best-selling author Morgan Housel grew up ski racing, and in his wonderfully written article titled The Three Sides of Risk, he shares the tragic details of an event that he lived through roughly 24 years ago.

It was in early 2001 when a couple of big storms hit Squaw Valley in Tahoe that he and two of his closest friends decided to head out of bounds and ski the back side of the mountain. Fresh, untouched snow, no rules, and challenging terrain. It’s what every experienced skier is after.

Their first attempt skiing the back side of the mountain was a success, minus a small knee-high avalanche that he said only added to the excitement.

When they safely got to the bottom to catch a ride back to civilization, Morgan’s two friends, Brendan and Brian, wanted to go back for round two.

Morgan, for an unknown reason that he still can’t explain today, opted out for the second attempt, but offered to pick them up in his truck at the bottom of the mountain so they didn’t have to hitch a ride back.

They solidified their plan and split ways. As they had discussed, Morgan went to the pickup spot at their agreed upon time. But his two friends never showed. The unimaginable had happened.

Search and rescue teams eventually found Brendan and Brian sometime after midnight, buried under six feet of snow. Their lives had been cut way too short at 17 years old. The entire article is worth reading and rereading, and I’ve linked to it for you in the show notes.

But you’re probably wondering, what exactly does this story have to do with investing? Well, everything, actually. As Morgan put it, this tragic event that occurred over two decades ago opened his eyes to the idea that there are three distinct sides of risk.

The odds that you will get hit, the average consequences of getting hit, and the tail end consequences of getting hit.

Getting hit is just a metaphor for an event occurring. It doesn’t have to be negative or tragic. It could be something positive. Most people can grasp the first two sides of risk, the odds of something happening, and the average consequence of that thing happening.

But the third one, he argues, can likely only be learned through experience.

The third side of risk is commonly referred to as tail risk.

In the investing world, the simplified definition of tail risk is the probability that an asset performs far below or far above its average past performance.

In other words, a tail risk event is an extreme event, positive or negative, that has a very small probability of occurring. As you would expect, most people are concerned about negative tail risk events, or I should say, most are concerned about them once they understand them and their consequences.

Morgan and his friends knew that skiing, especially skiing out of bounds, involved risks. They also knew that given their skill level and experience, the average consequences of skiing out of bounds were tolerable and survivable. What they didn’t fully grasp at the time were the tail end consequences of going off the grid and skiing out of bounds.

More specifically, they didn’t give much, if any, weight to the negative tail end consequences. And those low probability, high impact events are all that really matter. Here’s what Morgan had to say.

“My risk tolerance plunged after Brendan and Brian died. I broke my back skiing a few months later, which crushed my tolerance for risk even more. I haven’t skied much since, maybe 10 times in the last 15 years. If I’m honest, it scares me.

I’ve been risk averse in other areas of my life ever since, too. I drive the speed limit. I obey the seatbelt sign on airplanes. I invest in index funds.”

As Michael Batnick once put it, the biggest risk investors face is trying to eliminate every risk. How do I hedge against inflation? How do I limit volatility? How do I avoid drawdowns? Instead of trying to eliminate everything that can go wrong, the best investors find their sweet spot and let time do the rest.

Knowing that it likely isn’t wise for us to try and eliminate every risk, how can we best hedge against tail risk, the only risk that really matters?

First, to start, it’s important to understand how tail end consequences might impact you and your retirement plan. Said another way, you should probably have a tail event plan before the tail event. As Morgan noted, it’s often hard to fully wrap your head around the negative tail end consequences, and in many cases, you just have to experience it.

And perhaps you already have. Perhaps you lived a tragic event similar to Morgan’s, or the unimaginable happened in 08, 09, and not only did you lose your job, but your retirement savings dropped 60% in value. Or you got caught up in the .com bubble, lost everything and had to start over.

Those challenging experiences might have helped to reshape your investment philosophy and approach to taking risk.

Regardless, going through a comprehensive planning process and shocking your plan for low probability, high impact events can potentially help bring negative tail risk events to the surface, allowing you to identify opportunities to mitigate the consequences and document an ideal, disciplined response that keeps your emotions in check.

As I’ve said many times here on the show, knowledge is power, and knowing what could potentially put your retirement plan in jeopardy can help you make more informed decisions with your money and investments.

The next hedge against tail risk is time. As you extend your investing time horizon, you reduce the chances of a negative tail risk event destroying your plan. Long term investors on average will have a better and more positive investing experience than short term investors.

And lastly, since time is not on everyone’s side, the final hedge against tail risk, both positive and negative, is diversification. Let me first address why diversification allows us to actually benefit from tail events with positive outcomes.

In 2017, the S&P 500 rose 22%. 23 companies out of all 500 contributed to half of that return. Apple stock alone contributed to more of the return that year than the bottom 321 companies combined.

In 2021, the Nasdaq was up 32%. 25 companies out of 100 accounted for 75% of that total return.

In 2023, only 27% of stocks outperformed the S&P 500, making it the narrowest market since 1995. The trend continued last year in 2024, with just 28% of stocks beating the index, barking the second narrowest year in nearly three decades.

Lastly, according to JP Morgan, from 1980 to 2014, 40% of all of the companies in the Russell 3000 Index lost at least 70% of their value and never recovered.

I’ll say that again.

From 1980 to 2014, 40% of all of the companies in the Russell 3000 Index lost at least 70% of their value and never recovered.

If you were a stock picker, odds are slim that you would have known what stocks to own and what stocks to avoid every single year. You could have easily experienced a negative, potentially catastrophic outcome.

But if you took a more diversified approach and invested $100,000 in the Russell 3000 Index in 1980, it would have been valued at roughly $4.7 million by 2014.

Almost a 50x return during a time period when 40% of the companies in the index lost 70% of their value and never recovered.

By diversifying your investments and choosing to own the entire market through low-cost index funds, you are a direct beneficiary of tail events with positive outcomes.

In addition to having a properly diversified portfolio, it’s of course critical to have a war chest of cash and short-term bonds to weather unpredictable storms, as well as securing the right types of insurance. Not iPhone insurance or roadside assistance. Most people can skip those.

I’m talking about protecting against the big stuff that can destroy a plan like liability, disability, life and potentially long-term care.

Lastly, it would also be prudent to have a plan to monitor your investments and keep them in line with your investment policy statement.

Pay off debt, live below your means, and regularly review and update important documents like your will, trust, power of attorney, and advanced medical directive.

The combination of all these smart, diversifying decisions coupled with time and a clear understanding of the three sides of risk can dramatically reduce the chances that a low probability, high impact event puts your retirement plan in jeopardy.

Really quick, before we wrap up, many of you have reached out over the years asking about these complex investment products that more or less aim to hedge against tail risk.

There seems to be something new being advertised every time I turn around, but most of them are essentially sophisticated options trading strategies packaged up as an enticing product that in one way or another claim to provide a healthy amount of upside while mitigating the extreme downside.

Sounds pretty good.

And while the math behind some of these popular tail hedging strategies adds up in the textbook, implementing them effectively and cost-efficiently at scale in the real world has proven to be very challenging.

My friends at Alpha Architect wrote a short piece on the topic last year saying, tail hedging is not as easy as you may think.

1.) First off, it is a highly expensive endeavor. Most of the time, an investor is purchasing put options that simply expire worthless representing a 100% loss. Even when options are rolled, they become a constant drag on the portfolio, a drag that many would rather avoid and for good reason.

2.) Secondly, purchasing, timing and monetizing put options can prove to be a highly intellectual and emotional exercise and one that is extremely hard, if not impossible, to systematize effectively.

AQR came to a similar conclusion in a paper titled Chasing Your Own Tail, where they wrote the following, Today, many institutional investors are insuring against tail risk directly, often by purchasing put options or structuring callers.

Unfortunately, experience and financial theory suggest that the long-term cost of such insurance strategies will be larger than the payouts.

No surprise, really, the expected return for perpetual insurance buyers is negative, and conversely positive for insurance sellers. See the entire insurance industry.

To translate and summarize, tail hedging is an expensive form of insurance, and it’s even more expensive when it’s wrapped up in a product and made available for mom and pop investors to buy.

And while some individuals who dedicate every waking moment of their life to implementing these complex hedging strategies may find some success, it’s nearly impossible to do reliably and systematically.

There is no free lunch. Anyone offering you attractive upside with no or limited downside is not telling you the full story. So be careful, do your due diligence, and when in doubt, don’t invest in anything that you don’t understand.

Or as Peter Lynch once said,

“If you can’t explain it to a 10-year-old in two minutes or less, you should not own it.”

As Morgan Housel wisely concluded in his article, The Three Sides of Risk, In investing, the average consequences of risk make up most of the daily news headlines.

We spent the last decade debating whether economic risk meant the Federal Reserve set interest rates at 0.25% or 0.5%.

And then 36 million people lost their jobs in two months because of a virus. It’s absurd. Tail-end events are all that matter. Once you experience it, you’ll never think otherwise.

Once again, to view the articles and resources mentioned in today’s episode, just head over to youstaywealthy.com/237.

Thank you as always for listening, and I’ll see you back here next week.

Disclaimer

This podcast is for informational and entertainment purposes only and should not be relied upon as a basis for investment decisions. This podcast is not engaged in rendering legal, financial, or other professional services.