Today, I’m sharing how retirement investors can take action in this final episode of our Small Cap Value series.

Specifically, I’m discussing three things:

- When (and Why) it can make sense to pay MORE for an investment

- How to easily and properly evaluate different funds

- What small-cap value funds to consider

I’m also sharing two important reminders to consider before taking action and investing in this popular asset class.

Listen To This Episode On:

When You’re Ready, Here Are 3 Ways I Can Help You:

- Get Your FREE Retirement & Tax Analysis. Learn how to improve retirement success + lower taxes.

- Listen to the Stay Wealthy Retirement Show. An Apple Top 50 investing podcast.

- Check Out the Retirement Podcast Network. A safe place to get accurate information.

+ Episode Resources

- Stay Wealthy Episodes Referenced:

- Funds Mentioned:

- Valuation Methodoligies:

+ Episode Charts

+ Episode Transcript

This show is a proud member of the Retirement Podcast Network.

Taylor Schulte: Welcome to Stay Wealthy Podcast. I’m your host, Taylor Schulte, and today I’m wrapping up our Small Cap Value Investing Series by sharing how you can take action.

Specifically, I’m sharing three big things.

1.) Number one, why in some cases, it can actually make sense to pay more for an investment.

2.) Number two, how everyone, yes, everyone, can easily evaluate different mutual funds and ETFs.

3.) And finally, number three, what are some of the Small Cap Value Funds for investors to consider?

I’m also sharing a couple of really important reminders for listeners to take into consideration before taking action and investing their hard-earned money in this popular asset class. To view the research articles and charts supporting today’s episode, just head over to youstaywealthy.com/227.

Small Cap Value (Part 3): How to Find the “Best” Fund

According to studies done by Morningstar and Vanguard, investment fees are the best predictor of future returns.

In other words, based on this research, higher-cost investment funds are more likely to underperform lower-cost investment funds. As a very simple example, take the following two investments, the Ridex S&P 500 index fund and the Vanguard S&P 500 index fund.

Two funds targeting the same exact asset class and tracking the same index with the same stocks. Yet since 2006, the Vanguard fund has outperformed the Ridex fund by about 150%. How is that possible? Well, it’s possible because the Vanguard fund costs 0.04% per year to own, while the Ridex fund costs 1.62% per year to own.

In other words, it costs investors $1,620 per year for every $100,000 that they invest in the Ridex fund and only $40 per year to own the Vanguard fund. The extra $1,580 charged by the Ridex fund reduces the investors’ returns. In this case, over the last 18 years, it’s reduced returns by about 150%.

We see a similar situation play out with alternative investments and hedge funds.

The majority of alternatives and hedge funds underperform simple broad-based index funds.

And it’s not because the investment managers running those funds don’t know what they’re doing or they aren’t smart investors.

It’s typically because the fees are so high that they eat away at any of the excess returns that these often very smart people are able to produce. And this can be tough for many mom-and-pop investors to reconcile because in just about every other area of our lives, if we spend more money on something, we get a higher quality thing.

If I decide to spend more money on a car, I expect to get a better, nicer, more reliable car. If I pay extra money to upgrade my airplane ticket, I expect a better seat with more legroom and maybe some additional value ads like free food and drinks or free checked bags.

But the investment world is the exact opposite.

Typically, the more you pay for an investment, the worse of an investment return you get.

To be extra clear and to avoid any confusion, I’m strictly talking about investment costs here, which should not be confused with fees that you might pay for wealth management or financial planning services.

When it comes to paying for wealth management services, you should absolutely expect more value and more expertise and higher quality services from higher fee service models than lower fee service models.

Just like you would expect higher quality service and more value from an experienced CPA who has expertise helping people just like you than from an enrolled agent at your neighborhood H&R block.

Not everyone needs an experienced CPA who charges multiples of an H&R block, just like not everyone needs a full-service wealth management firm. But if you’re going to pay more for a professional service, you should absolutely expect to get more. The point here is that evaluating fees charged by professional service providers is different than evaluating the fees charged by a commoditized product like investment funds.

So again, higher-cost investment funds are more likely to underperform lower-cost investment funds over long periods of time.

And while following that philosophy when constructing a portfolio will most likely put investors in a good position for long-term success, it’s not always as simple as screening for the lowest cost options available, especially when investing in an asset class like small-cap value.

In some cases, depending on the asset class being targeted and the goals and expectations of an investor, a case can be made for paying more to get the desired exposure to an asset class.

In other words, there is evidence to suggest that in some cases, paying more for an investment should deliver more to the investor, more being higher expected future returns.

Before I expand it and share an example, I want to take a minute to remind everyone that investment companies, unfortunately, have quite a bit of flexibility with how they market and name their products.

Take, for example, the Invesco S&P 500 Low Volatility ETF, ticker SPLV, which is, quote, designed for an investor seeking exposure to US large-cap stocks with low volatility for both potential upside participation and risk mitigation.

Sounds pretty good, but rewind to the last major market meltdown in early 2020, and this fund dropped 33% slightly more than Vanguard’s Plain Vanilla S&P 500 fund. To be fair, 2020 was a unique time period, and the Invesco fund has, in fact, experienced slightly lower volatility than the S&P 500 since it launched, but it has also underperformed by 150%.

The point here is that just because a product is described as defensive, or strategic, or tactical, or in this case, low volatility with upside participation, just because a product has a captivating name and description, doesn’t mean you should take the marketing and messaging at face value.

It’s critical to look under the hood and do your proper due diligence before investing your hard-earned money.

In a similar vein, just because an investment fund is labeled a small-cap value fund, and is placed in the small-cap value asset class category by your custodian, doesn’t necessarily mean that you’re gaining the proper or desired small-cap exposure that you might be looking for.

For example, let’s look at two popular small-cap value funds. The Avantis Small Cap Value Fund, ticker AVUV, and the Vanguard Small Cap Value Fund, ticker VBR. The Avantis fund costs 0.25% per year to own, while the Vanguard fund only costs 0.07% per year to own.

In other words, the Vanguard fund is roughly 70% cheaper to own than the Avantis fund. On the surface, if both funds are investing in and providing exposure to the same exact asset class, why on earth would an investor choose to pay 70% more to invest in the higher-cost fund? It’s a good question and the right one to be asking. It’s the same question you would be asking if buying a car or shopping for airline tickets.

If you’re going to spend more, you’re going to want to confirm that you’re getting more.

Let’s now dive into the data and use what we’ve learned throughout the series to determine why or why not it makes sense to pay 70% more for a small cap value fund like the one offered by Avantis.

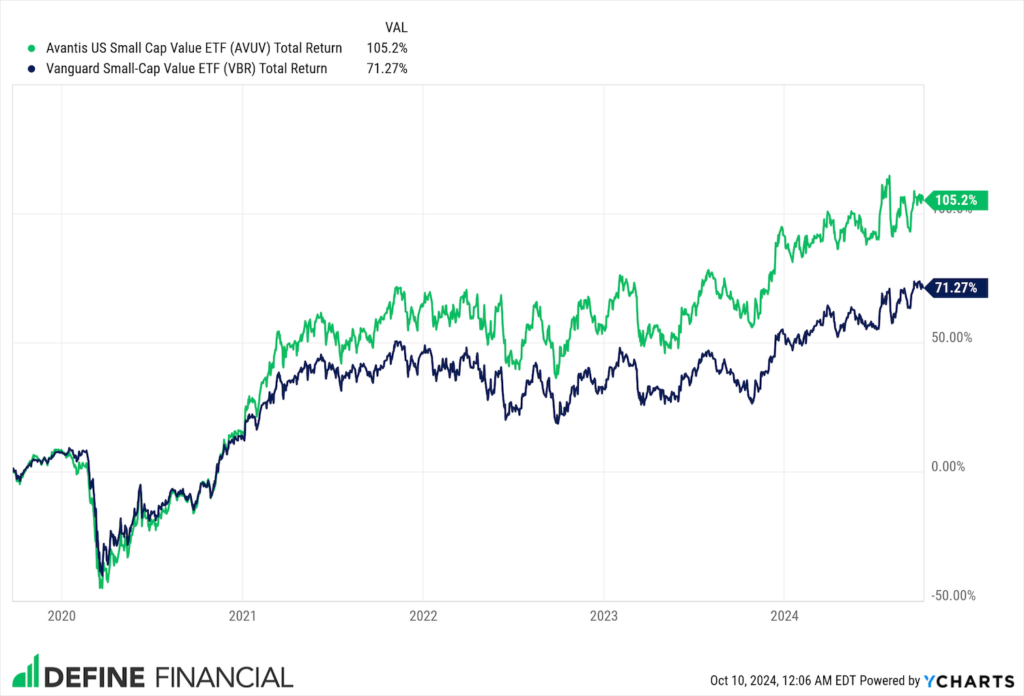

To start, the Avantis Small Cap Value Fund officially launched in September of 2019. Since then, the fund has produced a total positive return of 105% as of this recording. During this same exact time period, the Vanguard Small Cap Value Fund has only produced a positive return of 72%. So in this five-ish year time period, the higher-cost Avantis Fund outperformed the lower-cost Vanguard Fund by 33%.

How can this be? Well, one explanation could simply be that the five-year time period measured is just simply too short. And over a longer period of time, the lower-cost Vanguard Fund would or should outperform the higher-cost Avantis Fund. And while that is certainly a logical explanation based on what we know about investment fees, there’s more to uncover and understand here.

As we know after listening to part one and part two of this series, smaller companies have higher expected returns than larger companies, and value stocks have higher expected returns than growth stocks.

This in turn means that the smallest companies trading at the cheapest relative prices should produce the highest expected returns. With that in mind, let’s look under the hood of the two small-cap value ETFs that we’re evaluating and start by comparing the size of the companies that they’re investing in.

Remember, as noted in part one of this series, the market cap or market capitalization of a company is a measurement of its size. For example, Apple, the largest company in the world, has a market cap of over $3 trillion dollars. Mattel, on the other hand, the popular toy manufacturer, is a much smaller company with a market cap closer to $6 billion dollars.

Two very well-known companies, but two very different sizes.

So looking at the average market cap of all of the companies owned by a particular mutual fund or ETF will tell us precisely how large a large cap fund is, or for the sake of today’s conversation, how small a small cap fund really is.

And the good news is this information is public and it can be accessed for free and easily through the fund company’s website or a website like morningstar.com.

Starting with the Vanguard Small Cap Value Fund, again ticker VBR, this fund, as of today’s recording, invests in about 500 different companies. And according to Morningstar, the average market cap of these 500 companies is $6.63 billion. The Avantis Small Cap Value Fund, on the other hand, invests in about 700 different companies, and the average market cap of these companies is $2.5 billion.

In other words, the average company size owned inside the Avantis Fund is much smaller than the average company included in the Vanguard Fund, 62% smaller to be exact.

With that information alone, it shouldn’t be terribly surprising that the Avantis Fund, investing in smaller small-cap companies, outperformed the Vanguard Fund, which invests in larger small-cap companies.

But there’s still more information to evaluate, and that is the average relative price of all of the companies included in each fund or how undervalued or overvalued the companies included in the fund are.

However, unlike size, there is not a single agreed upon method for measuring the price of a company to determine how valuey it is.

I won’t get into the weeds and all the different methodologies here today and their pros and cons, so we’ll just keep it simple and stick with one of the more common or well-known valuation measures known as the price to earnings ratio or PE ratio for short.

At a very basic level, as it relates to today’s conversation, a lower PE ratio would suggest that a company is undervalued and has higher future expected returns, and a higher PE ratio would indicate that a company is overvalued and has lower future expected returns.

So if we’re looking to get as much exposure as we can to value companies trading at low relative prices, and we think the PE ratio is the most accepted measurement, we would want to look for value funds with lower PE ratios.

And fortunately, just like MarketCapInfo, these ratios can also be accessed easily and at no cost through the funds website or sites like morningstar.com. According to Morningstar, the PE of the Vanguard Small Cap Value Fund is 14.3, and the PE of the Avantis Fund is 10.4.

So combining these two factors, size and value, we’ve now learned that the Avantis Small Cap Value Fund is investing in smaller companies trading at lower relative prices than the Vanguard Fund.

Knowing that smaller, more valuable companies have higher expected returns, it shouldn’t be terribly surprising to see the Avantis Fund outperform over long periods of time.

It also shouldn’t be surprising to see more volatility in the Avantis Fund. As always, there’s no free lunch. A higher return requires higher risk, which highlights that this is not about one fund being better than the other. I’ll say that again. This is not about one of these funds being better than the other. It’s about understanding what we’re investing in and ensuring that it matches our needs, our goals and our desired level of risk.

If you invested in the Vanguard Small Cap Value Fund in September of 2019, with the expectation that you were going to capture as much of the Small Cap Value Premium as possible, you would be disappointed today when comparing your returns in the Vanguard Fund to the smaller, more valuey fund like the one from Avantis.

In this case, if you want more exposure to the Small Cap and Value Premiums, it does cost a little bit more to get that exposure. 17 more basis points, or 0.17% to be exact. The good news is, is that the fees charged by the Avantis Fund are reasonable. We’re not talking about 2% fund fees here. We’re talking about an extra 0.17%.

And because the fees are reasonable and properly aligned with what’s required to run and manage this fund, the extra returns captured by gaining proper exposure to the Small Cap Value Premium were not eroded by the fees like the Rydex example that I led with today.

I used the Avantis Fund today as an example, but there are other well-constructed Small Cap Value Funds that you can evaluate and research if you think including an allocation to this asset class is prudent and aligned with your unique retirement needs and goals.

For example, the US quantitative value ETF from Alpha Architect and the dimensional US Small Cap Value Fund, which is now publicly available to every investor in an ETF format, the ticker is DFSV.

A link to all of the funds referenced in today’s episode in the show notes as well as some additional resources to help you continue learning about investing in this popular asset class.

But before we part ways and wrap up this series, I want to leave you with two important reminders.

Number one, the Small Cap Value Premium is compelling and the evidence in support of including this asset class in a globally diversified portfolio is strong, but it requires patience and discipline in order to reap the benefits discussed in the series.

As noted by Brad Steinman at Dimensional, while a positive premium is never guaranteed, the odds of realizing one are decidedly in your favor and improve the longer you stay invested. The best investment is the one that you can stick with. There is no one size fits all solution, and excluding Small Cap Value from your low cost diversified portfolio likely won’t put your plan in jeopardy.

However, jumping from strategy to strategy and fund to fund, looking for quick wins will likely be a losing battle.

Number two, you absolutely should not pay more for an investment just because of its historical track record. In some cases, to get the desired exposure to a particular asset class, it does cost a little bit more. It costs the fund company a little bit more to run and operate a fund with a little bit more complexity, and those additional costs are passed down to investors.

You or your advisor need to do the proper research and due diligence to determine if paying a little bit more for an investment is justifiable. And while the historical performance data point can be part of your research, it absolutely should not be the primary reason for choosing a particular fund.

The Avantis Small Cap Value Fund did not outperform the Vanguard Fund because it’s better or it’s equipped with better managers who know how to outsmart the markets. It outperformed because it took more risk by investing in smaller, more valuey companies. I covered a lot in this series about a pretty nerdy investment topic, and I did my very best to keep it simple and actionable.

But if I left you with any unanswered questions, or if you found yourself confused about a particular concept, or just need some added clarification, please don’t hesitate to reach out. You can email me directly with your questions at podcast@youstaywealthy.com.

Once again, to grab the links and resources mentioned in today’s episode, just head over to youstaywealthy.com/227.

Disclaimer

This podcast is for informational and entertainment purposes only and should not be relied upon as a basis for investment decisions. This podcast is not engaged in rendering legal, financial, or other professional services.