In this article, I’m sharing how to avoid IRMAA (Income-Related Monthly Adjustment Amount).

In fact, learning how to avoid (or reduce) Medicare IRMAA can potentially save you tens of thousands of dollars in retirement.

These strategies can also help you take control of your tax bill and avoid overpaying the IRS.

If you’re ready to learn how to escape this pesky surcharge this year and beyond, you’ll enjoy this article.

Key Takeaways

- The Income-Related Monthly Adjustment Amount (IRMAA) increases Medicare premiums for high-earners.

- A Medicare recipient’s Modified Adjusted Gross Income (MAGI) from two years ago is used to determine current-year IRMAA surcharges.

- Finding opportunities to reduce MAGI in the current year is the best way to avoid IRMAA in future years.

Understanding IRMAA and Medicare Basics

IRMAA, or Income-Related Monthly Adjustment Amount, is an additional charge applied to your Medicare Part B and Part D premiums if your income exceeds a certain threshold.

In other words, the higher your income, the more you’ll have to pay for Medicare coverage.

The purpose of IRMAA is to ensure that higher-income Medicare beneficiaries contribute more to the program, thus helping to maintain its financial stability.

While you may not agree with its purpose, it’s critical to understand how IRMAA affects you and what you can do to mitigate the surcharge.

The Role of MAGI in Determining Medicare Premiums

Your Modified Adjusted Gross Income (MAGI) is your gross income, plus specific deductions like foreign income exclusion or tax-exempt interest, as reported on your federal income tax return.

If your MAGI exceeds the IRMAA threshold, you will be subject to higher Medicare premiums (Part B and Part D).

Specifically, the Social Security Administration examines your MAGI from two years ago to determine whether you’ll be subject to an Income-Related Monthly Adjustment Amount (IRMAA) in the current year.

In other words, your 2023 MAGI and tax filing status will determine if an IRMAA surcharge applies to you in 2025.

Similarly, your 2025 MAGI and tax filing status will be used to determine your 2027 Medicare IRMAA brackets.

As your income increases, your IRMAA will also increase.

That’s why it’s beneficial to stay updated on the ever-changing MAGI thresholds and related healthcare costs.

» Want to get stay updated? Review the Medicare IRMAA Brackets 2025, 2026, and 2027.

How to Avoid IRMAA

Reducing your Modified Adjusted Gross Income (MAGI) is the best way to avoid an Income-Related Monthly Adjustment Amount (IRMAA) for Medicare.

More specifically, reducing your 2025 MAGI can help you reduce (or avoid) IRMAA in 2027 and beyond.

To help you take action, I’m sharing the 9 best strategies to reduce your MAGI and potentially escape this pesky Medicare surcharge in retirement. 👇

1.) Charitable Giving

Charitable giving helps the non-profit organizations you donate money to. It can also help you by reducing your Modified Adjusted Gross Income (MAGI) for future IRMAA bracket calculations.

However, it’s important to emphasize that a cash donation to a qualified charitable organization will not reduce your MAGI. It will reduce your taxable income in the year it was made, but it won’t help you avoid IRMAA.

And that’s because charitable tax deductions fall “below the line” for Adjusted Gross Income (AGI) on the tax return.

Making cash donations can help reduce your current-year tax bill, but they will not affect your MAGI for IRMAA purposes.

If you are charitably inclined and want to reduce your MAGI, here are three (3) primary ways to make IRMAA-reducing donations.

#1 – Donating Appreciated Assets

Do you have appreciated investments like mutual funds, ETFs, or stocks?

If so, you can donate those appreciated assets directly to charity. In some cases, appreciated assets such as art, collectibles, and real estate can also be contributed.

Donating appreciated assets does two things:

- It avoids capital gains tax that the donor would otherwise pay if they sold the asset.

- It provides a tax deduction for taxpayers who itemize.

Only point #1 above will help reduce your MAGI. And that’s because capital gains are included in the MAGI calculation.

In other words, avoiding capital gains on a donated asset can help avoid IRMAA or reduce it.

On the other hand, if an appreciated asset qualifies for an itemized tax deduction (point #2 above), your overall taxable income would be reduced but not your Modified Adjusted Gross Income (MAGI).

Just like cash contributions, the charitable deduction line for donating appreciating assets falls below the AGI line on IRS Form 1040.

(Note: Limits, in terms of the percentage of your AGI that can be deducted do apply. Any excess amount will be carried over to a subsequent year for deduction purposes.)

#2 – Making Qualified Charitable Distributions (QCDs)

A Qualified Charitable Contribution (QCD) is a direct donation from your Traditional IRA to a qualified non-profit organization. If you are 70 ½ or older, you can make a (QCD) of up to $100,00 per year.

QCDs are not taxed and can be used to satisfy some or all of your Required Minimum Distribution (RMD).

In other words, if you have a $100,000 RMD this year, you can withdraw and donate $100,000 from your Traditional IRA and avoid the income from the RMD.

Required Minimum Distributions (RMDs) and the taxable income they create are a big reason why Medicare beneficiaries are subject to IRMAA.

Therefore, reducing your current and future RMDs by making Qualified Charitable Distributions (QCDs) can reduce your MAGI and help you avoid IRMAA.

#3 – Utilize a Donor-Advised Fund (DAF)

A Donor-Advised Fund (DAF) is an investment account used for charitable giving purposes only. Several major financial institutions offer DAF giving accounts (e.g., Fidelity Charitable, Schwab Charitable).

A Donor-Advised Fund allows you to make lump-sum irrevocable contributions to your giving account in the current year, receive a tax deduction for the amount contributed, and then distribute amounts to various charities over time.

For example, you can contribute $100,000 to your DAF account today, receive a tax deduction for the full amount this year, and distribute $5,000 per year for 20 years to various charities.

You can also invest the $100,000 DAF contribution in your giving account, allowing you to distribute a higher amount to charities in the future potentially.

Similar to other charitable giving methods mentioned above:

- Contributions to a DAF can be made with cash or appreciated securities.

- There are limits to the percentage of your AGI that can be used as a deduction.

- Excess donation amounts can be carried over to subsequent years.

A donor-advised fund is a great way to reduce your MAGI and avoid or reduce IRMAA adjustments in future years.

» Learn how a Donor-Advised Fund Can Help You Offset a Year-End Roth Conversion Tax Bill

2.) Tax Deductible Retirement Account Contributions

Making tax-deductible contributions is another way to reduce your Modified Adjusted Gross Income (MAGI) and potentially help keep you in a lower IRMAA bracket in subsequent years.

You can only make tax-deductible contributions to a retirement account if you have earned income. Some account options include:

- Traditional IRA

- Traditional 401(k), 403(b), or 457 plan

- Solo 401(k)

- SIMPLE or SEP IRA

There are contribution limits that are unique to each account and individual, but if you’re able to make tax-deductible contributions and want to avoid IRMAA, it’s a great option to consider.

3.) Tax-Free Retirement Income

When creating your retirement paycheck, you must be mindful of where you withdraw money. Some withdrawals are tax-free, and some are taxable.

By withdrawing money from tax-free sources, you can keep your taxable income low and reduce or avoid IRMAA in future years.

Here are three examples:

- Roth IRA: If you’re over age 59 ½ and have satisfied the “five-year rule,” withdrawals from a Roth IRA are tax-free.

- Reverse Mortgage: Do not get a reverse mortgage just for tax benefits. However, if you have other reasons for securing one, it does provide access to tax-free cash.

- Permanent Life Insurance: Certain types of permanent life insurance policies allow you to tap into the cash value tax-free. Before taking action, learn how the withdrawal process works for your specific policy and any restrictions that might be in place.

» Learn how to Navigate the Roth IRA 5-Year Rule and When Permanent Life Insurance Makes Sense

4.) Tax-Efficient Investments

You can further minimize your Modified Adjusted Gross Income (MAGI) by utilizing tax-efficient investments in your plan-vanilla brokerage accounts. In a brokerage account, you pay taxes on interest, dividends, and gains realized in the current year.

By choosing investments that mitigate those tax events, you can reduce your MAGI and potentially avoid an Income-Related Monthly Adjustment Amount (IRMAA) in the future.

Here are four examples:

- Avoid high-turnover mutual funds. These pooled investment funds frequently buy and sell securities, creating unnecessary capital gains that investors must pay. Choosing low-turnover, passive index funds instead (e.g., Vanguard Total Stock Market Fund) will help mitigate capital gains and, in turn, reduce or avoid IRMAA.

- Avoid high-dividend investments. While dividends sound nice, they increase your tax bill. High-dividend mutual funds are also expensive, explaining their poor historical performance. If you want to boost returns, lower taxes, and avoid IRMAA, skip high-dividend investments.

- Stay Away from Insurance Products: Even though insurance products are advertised as “tax-efficient,” popular solutions like Indexed Universal Life (IUL) insurance are bad investments due to high fees and surprise tax bills.

- Choose ETFs over mutual funds. Mutual funds pass capital gains down to the investors. Even if you don’t trade your mutual fund, you can still be on the hook for unwanted capital gains taxes due to activity inside the fund. In most cases, ETFs avoid this problem and mitigate capital gains, helping to avoid IRMAA.

- Consider asset location. If you have investments in both taxable and tax-advantaged retirement accounts, asset location can help minimize taxes. For example, consider placing bonds in tax-advantaged retirement accounts because they generate taxable income. Broad-based stock funds (e.g., S&P 500 ETF) often fit better in taxable brokerage accounts. Meanwhile, investments with the highest future return potential (e.g., small-cap value or emerging markets funds) suit a Roth IRA best.

» Learn about the Top 3 Tax Savings Tips That Fly Under the Radar

5.) Tax-Efficient Withdrawal Strategies

In retirement, it’s critical to have a withdrawal strategy that generates consistent, reliable income. It’s also important that your chosen withdrawal strategy is tax-efficient.

Tax-efficient withdrawal strategies in retirement can help lower your Modified Adjusted Gross Income (MAGI) and reduce IRMAA surcharges.

Here are three things to keep in mind when evaluating a withdrawal strategy:

- Implement a systematic withdrawal process. Create a rules-based withdrawal plan documenting where and when you will take distributions from retirement accounts. This can help you maximize your retirement paycheck, mitigate taxes, and avoid IRMAA.

- Adopt a withdrawal strategy backed by academic research. For example, The 4% Rule, Floor and Ceiling, Guyton’s Guardrails, and Total Return Investing. Peer-reviewed academic research supports these evidence-based approaches to creating income in retirement.

- Commit to one withdrawal strategy. While the grass might look greener in a few months, staying committed to your chosen withdrawal plan will put you in the best position for success. Periodically changing withdrawal strategies will lower your returns and increase fees and taxes.

» Learn more about Dynamic (Tax-Efficient) Withdrawal Strategies in Retirement

6.) Medicare Savings Accounts (MSAs)

MSAs have two components:

- Medicare Advantage Plan (Part C). This includes a high-deductible health plan that only starts paying eligible expenses once you meet the deductible.

- Medical Savings Account (MSA). The plan establishes this savings account at a selected bank, and Medicare contributes a set amount to the account at the start of each year. The funds can cover out-of-pocket medical expenses, including those not covered by Medicare.

Like an HSA account, any money not used at the end of the year will carry over to the next year.

Additionally, Medicare contributes to the MSA tax-free, and withdrawals remain tax-free if used for qualified medical expenses.

Utilizing an MSA can improve your tax picture, mitigate your Modified Adjusted Gross Income (MAGI), and potentially help avoid IRMAA (or reduce it).

» Learn more about Navigating Medicare in Retirement

7.) Roth Conversions

At age 73 or 75, the IRS forces you to begin withdrawing money from your Traditional IRA/401(k) accounts. These forced withdrawals, known as Required Minimum Distributions (RMDs), are taxed as ordinary income.

RMDs can be hundreds of thousands of dollars per year, causing unwanted Medicare IRMAA surcharges.

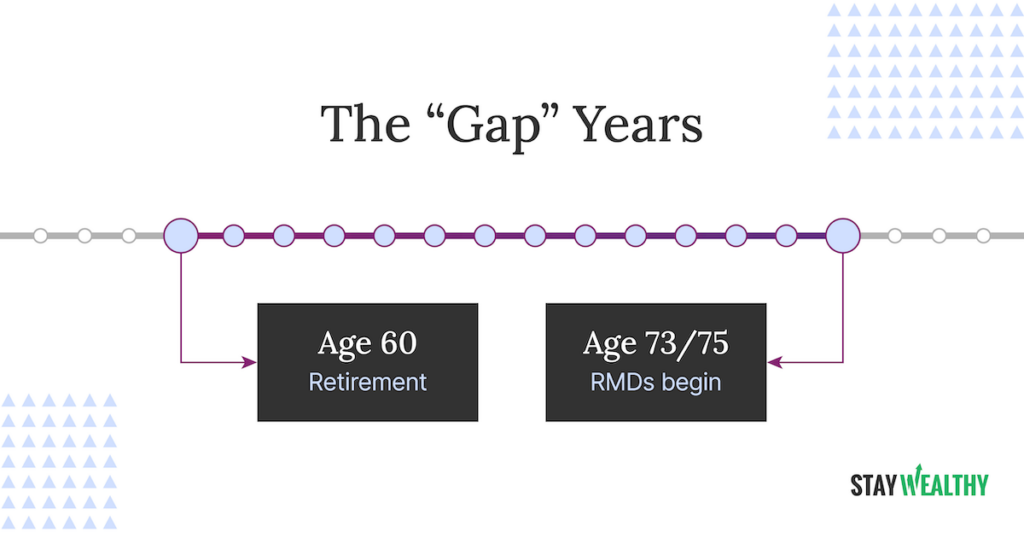

Consider doing Roth conversions during your “gap” years to reduce your future RMDs (and your future taxable income).

A Roth conversion is the process of withdrawing money from your Traditional IRA, paying taxes on the withdrawal, and immediately transferring the dollars to a Roth IRA.

Your gap years begin when you retire and end at age 73 or 75 (when RMDs begin).

For most retirement savers, income is the lowest during this period of time, allowing them to get money out of their Traditional IRAs at a favorable tax rate via Roth conversions.

» Learn more about Roth Conversions, What They Are, and How to Implement Them

8.) Tax Gain Harvesting

Tax Gain Harvesting is a little-known strategy that can help you manage your tax bill and potentially avoid IRMAA.

Long-term capital gains have their own tax bracket. Depending on your income, you can sell investments with long-term gains at a 0% tax rate. (i.e., You don’t pay ANY taxes on the profits.)

For 2025, the 0% bracket for long-term capital gains extends to income up to $48,350 for single filers and $96,700 for married filing jointly.

Tax-gain harvesting minimizes future gains that you will need to realize when your income includes Social Security and Required Minimum Distributions (RMDs).

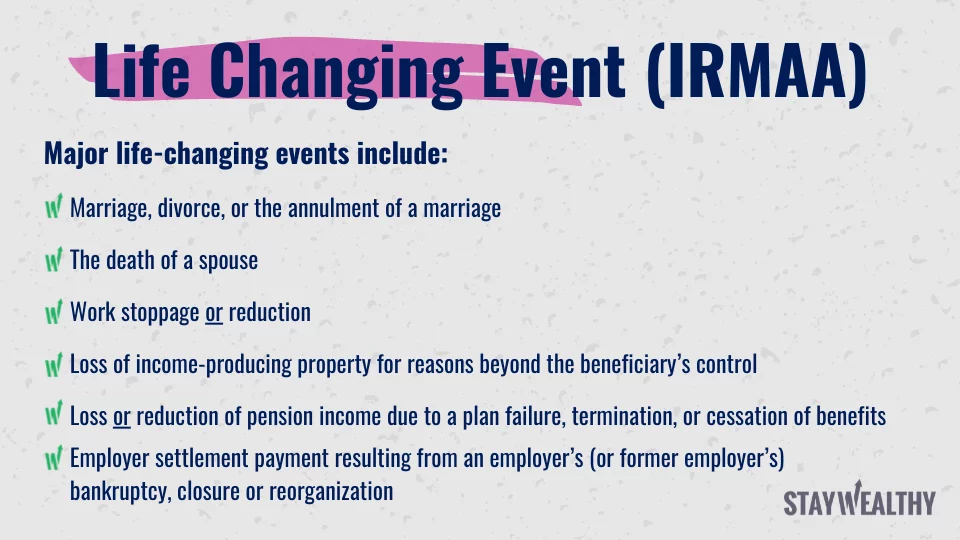

9.) Life-Changing Event

If you’ve experienced a life-changing event (as defined by the Social Security Administration) AND are subject to IRMAA in 2025, you can request to have your IRMAA surcharge reconsidered. Start the reconsideration process by calling the Social Security Administration at 800-772-1213 and/or completing Form SSA-44.

Frequently Asked Questions

What are the current income thresholds for triggering IRMAA?

To determine whether you’ll be subject to IRMAA, Medicare looks at your Modified Adjusted Gross Income (MAGI). The 2025 MAGI thresholds for IRMAA purposes start at $106,000 for a single person and $212,000 for a married couple. In 2025, IRMAA can cause Medicare Part B monthly premiums to increase by as much as $443.90 and Part D monthly premiums by as much as $85.00. Review the 2025 Medicare IRMAA brackets closely to determine if you are subject to higher premiums this year.

How long will I be subject to IRMAA after a high-income year?

An Income-Related Monthly Adjustment Amount (IRMAA) is based on your Modified Adjusted Gross Income (MAGI) from two years prior. For example, your 2025 IRMAA surcharges are based on your 2023 MAGI. If you experience a high-income year, you may be subject to increased Medicare premiums for the next two years due to IRMAA. However, if your income situation changes, you can report it to the Social Security Administration for reconsideration by submitting Form SSA-44.

Are there any legal methods to appeal against an IRMAA determination?

Yes, you can request an IRMAA reconsideration if you disagree with the determination. You need to submit a request to the Social Security Administration within 60 days of receiving the determination notice. Provide proof of your current income and any life-changing events that might have affected your income. The IRMAA reconsideration form can help you through this process.

Hey there! I’m the founder of Define Financial, a commission-free retirement planning firm ranked #2 in the U.S. by Investopedia. We specialize in helping people aged 50+ reduce taxes, invest smarter, and create a retirement paycheck. I’m also the host of the Stay Wealthy Retirement Show, a Forbes Top 10 podcast and member of the Retirement Podcast Network. When I’m not helping retirees reduce taxes, you can find me traveling with my family, searching for the next best carne asada burrito, or trying to master Adam Scott’s golf swing.