Today I’m sharing everything you need to know about donor-advised funds.

In fact, these simple giving accounts can help you lower your tax bill this year and beyond.

They can also help you give more money to the charities you love and support.

If you want to learn how to maximize your charitable giving and reduce taxes, this comprehensive guide is for you.

First, grab these free charitable giving resources:

- What You Should Consider When Establishing a Giving Plan [PDF Checklist]

- How to Determine If You Should Use a Donor-Advised Fund [PDF Flowchart]

- Can You Donate Money from my IRA? [PDF Flowchart]

Key Takeaways

- Donor-advised funds provide an immediate tax deduction in the year you make your contribution

- You can invest assets in your donor-advised fund to increase the amount you give over time

- Donor-advised funds streamline how you make + track charitable donations

- Donor-advised funds allow you to support your favorite charities at your own pace

- These low-cost giving vehicles can help you donate more and get a bigger tax deduction in the current year

What Are Donor-Advised Funds (DAFs)?

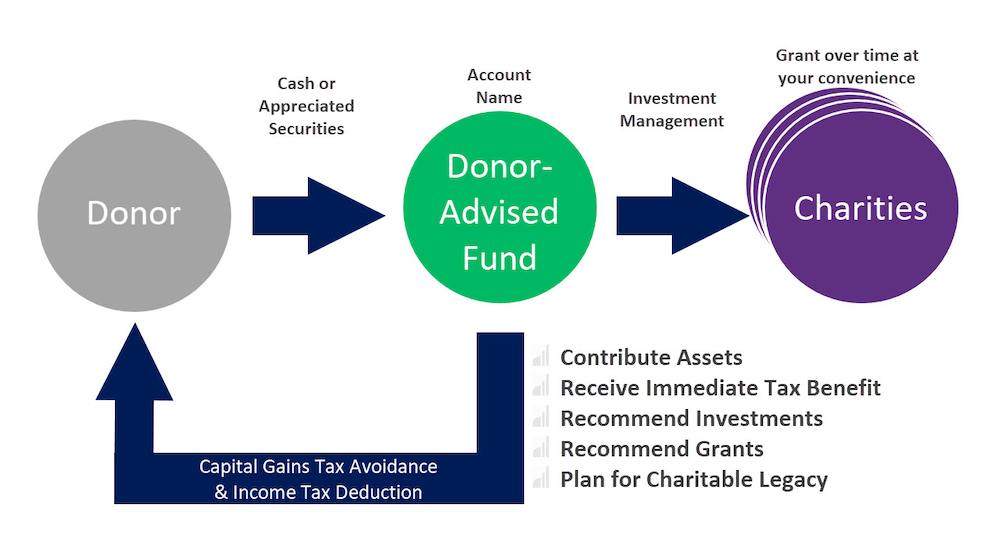

A donor-advised fund (DAF) is an investment account you can only use to benefit qualified charities.

To get more technical, it’s a separate account opened with and maintained by a 501(c)(3) “sponsoring organization” (a.k.a. donor-advised fund provider).

Individuals can make a lump-sum contribution to their DAF account, take an immediate tax deduction, and advise on distributions to qualified charities over time.

The rise in popularity of donor-advised funds has made it easier for people to give more money tax-efficiently. In fact, one of the most surprising charitable giving statistics is that Americans donated a record $471 billion in 2020.

How Do Donor-Advised Funds Work?

To help explain how donor-advised funds work, I’ve created a simple five-step process.

Step #1: Open Your Donor-Advised Fund

Unlike a traditional investment or retirement account, donor-advised funds need to be opened with a “sponsoring organization” (a.k.a. donor-advised fund provider).

For example, Fidelity Charitable, Schwab Charitable, and Greater Horizons are a few popular sponsoring organizations.

Step #2: Fund Your DAF

After you open your DAF account, the next step is to fund it with cash or a range of acceptable assets (e.g., stocks, gold, bonds, real estate).

It’s important to remember that your donor-advised fund contribution is irrevocable.

In other words, once you fund your DAF account, the money is no longer yours. It belongs to the sponsoring organization maintaining your donor-advised fund account (e.g., Fidelity Charitable).

While you still have wide discretion over where your individual donations ultimately go, you can never take the money back or use it for your own benefit.

Step #3: Deduct Your Contribution

In order to deduct your donor-advised fund contribution(s), you need to itemize your deductions on your tax return. In other words, your total deductions need to exceed the standard deduction limit.

The standard deduction in 2024 is higher than previous years.

With a higher standard deduction, it’s even more challenging to itemize deductions on your annual tax return and benefit from charitable donations.

However, the higher limits also make the strategic use of donor-advised funds even more attractive.

Funding With Cash

If you itemize your deductions and fund your DAF account with cash, the total dollar amount is tax-deductible in the year you make that contribution, up to 60% of your Adjusted Gross Income (AGI).

Funding With Non-Cash Assets

If you fund your DAF account with a non-cash asset (e.g., stocks, bonds, gold, real estate) you have owned for more than one year, its fair market value is tax-deductible, up to 30% of your AGI.

(Note: if your donations are equal to or higher than the amount you can deduce in a given year, you may be able to “carry forward” excess contributions for the next five years.)

Step #4: Manage Your Donor-Advised Fund

If you’ve funded your DAF account with an appreciated asset, the sponsoring organization will sell it without any tax consequences.

Once sold, you can typically select whether you want the proceeds to remain in cash or be invested.

If they are invested, any future growth, dividends, or interest is tax-free because the investment activity is happening inside a charitable account.

Step #5: Distribute to Charities

Finally, at your leisure, you can advise your DAF sponsor to make grants to the charities you want to support.

You simply select your desired charity and note the amount you want to give, and the sponsoring organization (e.g., Fidelity Charitable) will write and send the check. (By the way, your donation can be anonymous if you prefer.)

What Type of Assets Can You Contribute to a Donor-Advised Fund?

Although it is up to the sponsoring organization to decide what they will accept, below are popular non-cash assets that can typically be contributed to donor-advised funds:

- Publicly traded stock

- Mutual funds

- Bonds

- Privately held business interests

- IPO stock

- Cryptocurrency

- Oil and gas royalties

- Real estate

- Gold or silver

- Collectibles

- Fine art

As mentioned above, while you can donate cash, it can be particularly beneficial to donate a “long-term” appreciated asset (i.e., one you’ve held for at least one year) to receive a deduction for the full market value.

If you donate an investment you’ve held less than a year, you can only deduct your cost basis (i.e., the amount you paid for it).

For example, if you donated stock on the 365th day of owning it when it was worth $100,000 and you’d bought it for $100, you could only deduct $100.

If you waited just one more day until you’d held it for more than a full year, you would get a tax deduction for the fair market value on that day.

By taking an informed approach, your deductible amount would be much closer to $100,000 than $100.

With the appreciation of real estate, cryptocurrency, and stocks over the past decade…

…now is a particularly appealing time to donate highly appreciated investments (held for at least one year!) to a donor-advised fund.

How Much Should You Donate to a Donor-Advised Fund?

Here are three things to consider when determining how much you should donate to a donor-advised fund.

1.) Consider Your Deductible Limits

Although much depends on your circumstances, there are limits to be aware of.

- If you donate cash, you can deduct up to 60% of your Adjusted Gross Income (AGI). (Note: The Taxpayer Certainty and Disaster Tax Relief Act of 2020 temporarily increased individual limits to 100% of AGI through 2021; time will tell whether Congress extends the increased limit into future years.)

- If you donate long-term, highly appreciated assets, you can typically deduct up to 30% of your AGI.

If you donate more than you can deduct in any given year, you can carry the excess contributions over for up to five years.

To add more clarity to the AGI limitations, if your AGI is $100,000 (and ordinary limits apply), you could deduct $60,000 of a cash contribution or $30,000 of long-term, highly appreciated asset(s).

So, if you donated $50,000 of long-term, highly appreciated investments today, you could deduct $30,000 in the current year, and $20,000 would carry forward to future tax years.

Assuming the same $100,000 AGI next year, you could fully use the remaining $20,000 of charitable deductions. (Although, for couples filing jointly, you’d need additional itemizable expenses to exceed the standard deduction.)

2.) Factor in Your Intent

Now that you know the limitations, the amount you should donate depends on your charitable intentions.

As a rule of thumb, most investors are comfortable committing to about 5–10 years’ worth of giving in the current year.

For example, if you plan to give $10,000 per year for the foreseeable future, a reasonable amount to donate to a donor-advised fund would be $50,000–$100,000.

(Reminder: don’t forget to consider the AGI-based limitations described above to ensure the donation will actually translate into a tax-deductible benefit for you.)

Generally speaking, it can become tricky to plan much further out than that; tax policies, as well as your own life, can dramatically change over time. Then again, for every generality, there are exceptions.

For example, it may make sense to give more if you are in a very high marginal tax bracket for one year and don’t plan to be in a high tax bracket later.

This exception may apply in many scenarios, such as selling a business and retiring. You may also want to give less for various reasons.

The key is to be intentional about the amount you are giving and ensure it aligns with your long-term tax plan.

3.) Do the Taxable Math

Another way to think about how much you’d like to give to your donor-advised fund is to estimate how much you could save in taxes.

Since a charitable contribution is going to save you money at your highest marginal tax rate, the first step is to determine your rate.

If you are $30,000 into the 32% marginal tax bracket, you could contribute up to $30,000 and save $0.32 on every $1 you contributed.

If you contributed more, the first $30,000 of the contribution would save you $0.32 per $1, but then amounts above $30,000 would save you $0.24 per $1, because you would fall into the 24% tax bracket.

There is no magic in deciding how much to contribute. The key is to consider the tax rate you are in today compared to future expectations.

Are you okay saving money at your highest marginal tax bracket today?

If the answer is yes, consider a donor-advised fund as part of your planning.

Donor-Advised Fund Case Study: The Smith Family

Hannah and Steve Smith are a charitably inclined couple who normally give $5,000 to 10 different charities each year via cash, check, and credit card.

They enjoy giving but dislike having to save receipts and maintain detailed records about it.

Besides, since their home is paid off, they don’t have enough other itemizable deductions to exceed the standard deduction.

This means they don’t receive a tax deduction for their annual charitable contributions.

The Smiths Set Up a Donor-Advised Fund

Hannah and Steve bought Apple stock in a taxable account more than ten years ago. Since then, the stock has significantly increased in value.

They learn about donor-advised funds and how they could donate some of their Apple stock without realizing (and paying!) capital gains tax to do so.

Since they plan to continue giving $5,000 per year for the foreseeable future, they decided to donate $40,000 worth of their highly appreciated Apple stock to a donor-advised fund this year.

This helps them reduce the risks related to a concentrated exposure to one company.

It also fulfills the next 8 years of charitable giving.

Since the Apple shares have been held for more than a year, they receive an immediate $40,000 tax deduction.

This amount — combined with their other itemizable deductions — allows them to finally deduct their charitable giving (along with any other itemizable expenses they’ve incurred this year) for the first time in many years.

Hannah and Steve are in the highest 37% tax bracket in the year they fund their DAF. This means their $40,000 deduction is expected to save them $14,800 in taxes.

And that’s not even including other deductible expenses they may be able to itemize. They weren’t able to itemize before, so this is a big change for them.

Once the Apple shares are in the donor-advised fund, they are sold with no tax ramifications. The cost basis of those shares was $2,500, but since they were sold inside the fund, no capital gain taxes are due.

If the Smiths had sold the shares themselves, they would have incurred a taxable capital gain of $37,500 (the $40,000 fair market value minus their $2,500 basis).

Since they are in the highest tax bracket, they would have paid $8,925 in capital gains taxes (at the highest 20% + 3.8% Medicare surtax capital gain rate).

Speaking of surcharges, the Medicare IRMAA brackets 2024 highlight another “phantom tax” that DAFs can help combat, an Income-Related Monthly Adjustment Amount (IRMAA).

In fact, donor-advised funds are one of the best ways to avoid IRMAA.

Making the Most of Their Donor-Advised Fund

Next, the Smiths decide to invest the proceeds from their Apple stock sale into an 80% stock and 20% bond portfolio within their donor-advised fund account.

The year the did this transaction happened to be a remarkable year for stocks.

So, although they still gave $5,000 from the fund to the same charities they normally support each year, their account grew nicely.

Moreover, the Smiths were able to:

- Finally, itemize their tax deductions, at least in the year they set up their fund

- Avoid paying capital gain taxes on the donated Apple shares

- Invest the assets in their donor-advised fund account, allowing them to give more to charity over time

- Continue supporting the same charities they supported before

- Minimize the need to track their individual charitable donations; they made a single donation of their Apple shares to their donor-advised fund, and the fund transacted their giving requests from there

While donor-advised funds aren’t ideal for everyone under every circumstance, the strategy worked well for Hannah and Steve.

They were able to lower their income and capital gains taxes and reduce the time spent writing multiple checks for myriad donations.

List of Donor-Advised Fund Providers (Sponsoring Organizations)

As mentioned in this article, the first step is to open a DAF account with a donor-advised fund provider (i.e., sponsoring organizations). There are three different types of providers:

- National

- Community (e.g., San Diego Foundation, Madison Community Foundation)

- Single-issue/Cause-specific (e.g., American Cancer Society, National Christian Foundation)

Community and cause-specific providers are great if you know exactly who or what you want to support every year. They help take a lot of the guesswork out of choosing a charity and make the process easy.

However, if you want flexibility and freedom with your donations — including the ability to donate to specific causes when desired — a national provider likely makes the most sense.

Here’s a list of donor-advised funds (National) to consider:

- Fidelity Charitable

- Schwab Charitable

- Greater Horizons

- T. Rowe Price Charitable

- American Endowment Foundation (AEF)

- National Philanthropic Trust (NPT)

- Vanguard Charitable

- BNY Mellon Charitable Gift Fund

- Charity Vest

Looking for a community or cause-specific donor-advised fund provider?

Consider asking your favorite organizations if they have a donor-advised fund. If not, ask if they know of one that directly supports their cause.

You can also head to the internet for a quick search.

For example, if you type “Austin, Texas donor-advised fund” into Google, you’ll quickly find the Austin Community Foundation as an option in the results.

Final Thoughts

If you are charitably inclined, a donor-advised fund may fit well within your greater financial and tax planning strategies.

They can:

- Help you accrue itemizable deductions in excess of today’s high standard deduction (at least in the years you establish or add significantly to your fund)

- Reduce your overly concentrated investment risks by donating highly appreciated investments to charity

- Save you time and effort when making multiple annual donations to various organizations

Plus, having your charitable giving in one place can simplify your life and ability to make charitable grants by clicking a few buttons on your computer or cell phone.

All this said, there are caveats to be aware of if you plan to use a DAF in your planning.

To name a few, you’ll want to be mindful of fees being incurred, keep an eye on any evolving tax code changes that may impact your plans, and be aware of the rules on what types of donations qualify for DAF distributions.

Bottom line, whether you’re considering a donor-advised fund or any other form of charitable giving, you should talk with your accountant or financial planner about how to structure your ideal giving plan.

By proceeding from an informed perspective, you’ll do yourself and your intended recipients a big favor.

Elliott Appel is a financial planner and the founder of Kindness Financial Planning. He hosts the podcast Making the Most of Time which focuses on helping widows, caregivers, and people affected by major health events navigate grief, money, and loss. He also started the blog I Talk About Money for people in their 20s and 30s to learn how to be smarter with their finances and have a better relationship with money.