The 2026 Medicare IRMAA brackets are here.

And if your income exceeds certain thresholds, you could pay nearly $10,000 per year in Medicare premiums.

The frustrating part? Most retirees don’t find out until they get a letter from Social Security—after it’s too late to do anything about it.

In this guide, I’ll show you:

- The exact 2026 IRMAA income thresholds for individuals and married couples

- How Medicare calculates IRMAA (and why they use your tax return from two years ago)

- Proven strategies to reduce or completely avoid the surcharge

If you want to learn how to use the IRMAA 2026 brackets to navigate and avoid this surcharge, you will enjoy this article.

Key Takeaways

- IRMAA is a pesky monthly fee that affects high-earning Medicare members.

- Your 2026 IRMAA is based on your Modified Adjusted Gross Income (MAGI) from 2024.

- The Medicare Part B 2026 standard monthly premium is $202.90.

- The 2026 IRMAA brackets can increase Medicare Part B monthly premiums by as much as $487.00.

- The 2026 IRMAA brackets can increase Medicare Part D monthly premiums by as much as $91.00.

- To appeal IRMAA in 2026, you must file Form SSA-44.

- From 2007 to 2025, IRMAA bracket increases ranged from 4.73% to 8.02%.

- Reducing your Modified Adjusted Gross Income (MAGI) will help you reduce or avoid IRMAA in future years.

What Is IRMAA for Medicare

IRMAA stands for Income Related Monthly Adjustment Amount. It is determined by the Social Security Administration and represents an increase to Medicare Part B and Part D standard monthly premiums.

Put simply, IRMAA is a pesky monthly surcharge that Medicare members must pay if they make too much money.

What income is IRMAA based on?

An Income Related Monthly Adjustment Amount (IRMAA) is based on your Modified Adjusted Gross Income (MAGI) from two years ago.

In other words, the 2026 IRMAA brackets are based on your MAGI from 2024.

If the 2024 amount is unavailable, your 2023 MAGI is used to calculate IRMAA.

How is IRMAA calculated?

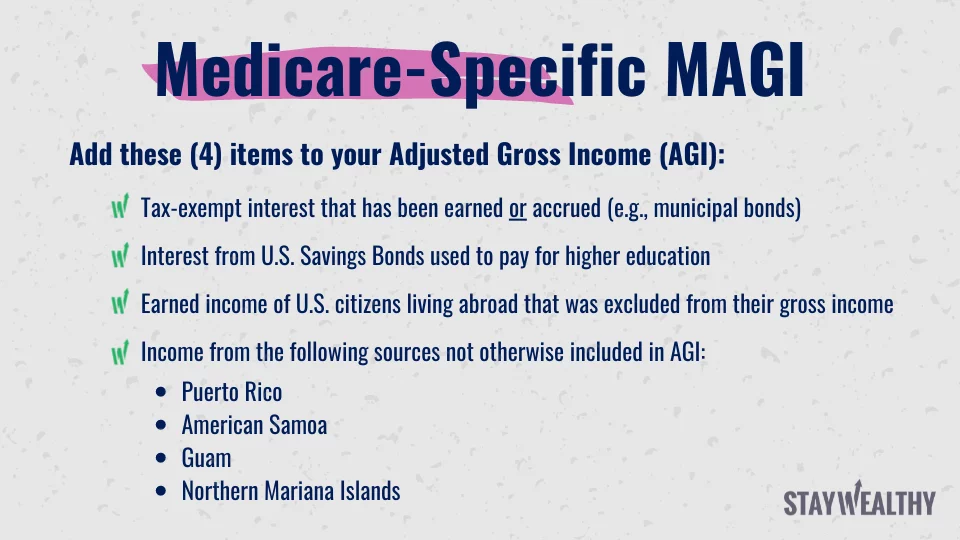

An Income Related Monthly Adjustment Amount (IRMAA) calculation is based on a Medicare-specific form of a beneficiary’s Modified Adjusted Gross Income (MAGI).

To calculate your MAGI for the 2026 IRMAA brackets, grab your 2024 tax return and locate your Adjusted Gross Income (AGI).

Then, add any tax-exempt interest earned or accrued (e.g., municipal bonds) and interest from U.S. Savings Bonds used to pay for higher education.

You must also add earned income while living abroad and income from specific sources not included in your AGI (Puerto Rico, American Samoa, Guam, and Northern Mariana Islands).

The total amount will represent your 2023 Modified Adjusted Gross Income (MAGI), specific to the Medicare IRMAA brackets 2026.

What Are the 2026 IRMAA Brackets

Your 2026 IRMAA bracket is determined by your tax filing status and Modified Adjusted Gross Income (MAGI) in 2024.

Here is how it breaks down. 👇

Medicare Part B and Part D IRMAA

In 2026, the standard monthly premium for Medicare Part B increased to $202.90. This is a 9.7% increase from 2025, reminding us that medical costs often exceed the inflation rate.

On the other hand, the average standard monthly premium for Medicare Part D will decrease to $38.99 this year.

(Note: Medicare Part D premiums vary by state and plan selection, and your premium may be higher than the standard published rate.)

Medicare recipients will face higher Part B and D monthly premiums in 2026 due to IRMAA if their 2024 income was:

- Above $109,000 for individuals filing a single tax return

- Above $218,000 for those filing a joint tax return

Because of IRMAA, Medicare premiums can increase significantly in 2026—with Part B monthly premiums rising by up to $487.00 and Part D premiums increasing by as much as $91.00.

The table below will help you determine exactly where you land in the 2026 Medicare IRMAA brackets.

to $137,000 | to $274,000 | |||

to $171,000 | to $342,000 | |||

to $205,000 | to $410,000 | |||

and less than $500,000 | and less than $750,000 | and less than $391,000 | ||

IRMAA Case Studies

Now you know what IRMAA is, how it is calculated, and what the Medicare IRMAA brackets 2026 are.

But what does this information look like when it is applied to a real-life situation?

Below are two hypothetical IRMAA case studies that show how this pesky surcharge works in practice.

IRMAA Case Study #1: Mary

Individual Tax Payer

- Mary’s Modified Adjusted Gross Income (MAGI) was $108,500 in 2024.

- She will not be subject to IRMAA in 2026 because her MAGI is below the $109,000 threshold.

- Her 2026 Medicare Part B premium will be $202.90/month (no IRMAA surcharge).

- Her 2026 Medicare Part D premium will be based on what her plan charges (no IRMAA surcharge).

IRMAA Case Study #2: Bill and Barbara

Married Filing Jointly

- Their Modified Adjusted Gross Income (MAGI) was $218,500 in 2025.

- They will be subject to IRMAA in 2026 because their income slightly exceeded the $218,000 threshold.

- Their 2026 Medicare Part B total premium will be $284.10 per month (base premium of $202.90 + IRMAA surcharge of $81.20).

- Bill and Barbara’s 2026 Medicare Part D total premium will be their plan premium plus a surcharge of $14.50 per month.

How to Avoid IRMAA

Lowering your Modified Adjusted Gross Income (MAGI) is the best way to avoid IRMAA (or reduce it).

For example, if you’re still working and have earned income, making tax-deductible contributions to a retirement account will reduce your MAGI and potentially reduce or avoid IRMAA in future years.

A few other strategies to avoid IRMAA (or reduce it) include:

- Adopting a tax-smart retirement withdrawal strategy

- Allocating to tax-efficient investments

- Utilizing a Medicare Savings Account (MSA)

- Tax-Gain Harvesting

- Processing Roth conversions

- Requesting a recalculation of IRMAA due to a “life-changing event” using Form SSA-44

- Making Qualified Charitable Distributions (QCDs)

Even if avoiding an Income-Related Monthly Adjustment Amount in 2026 isn’t possible, it’s still wise to regularly evaluate ways to reduce your Modified Adjusted Gross Income, which can help lower IRMAA in future years.

And just like your personal situation, tax laws can—and do—change, sometimes creating new opportunities to reduce taxable income and avoid IRMAA down the road.

» Learn about the 9 Best Ways to Avoid IRMAA and Lower Medicare Costs

IRMAA Appeal Form (and How to Appeal IRMAA)

To appeal IRMAA, you must complete and submit the IRMAA appeal form Form SSA-44.

In addition to the life-changing events, you can appeal your IRMAA adjustment if you think incorrect data was used to calculate the Income Related Monthly Adjustment Amount (IRMAA).

For example, the Social Security Administration might have overlooked an amended tax return, incorrectly pushing you into a higher Medicare IRMAA bracket in 2025.

Here are three different ways to appeal an IRMAA:

- Request a new “initial determination” from Social Security.

- Submit Form SSA-44.

- Call the Social Security Administration directly at (800) 772-1213.

If an IRMAA appeal is denied, don’t panic. Multiple levels of the appeal process provide additional opportunities to make your case.

Lastly, here are the important deadlines for appealing IRMAA:

- You’re only given 60 days to request an appeal.

- The 60-day clock begins when you receive your Part D IRMAA letter.

- The Social Security Administration assumes you will receive your letter five days after it’s time-stamped.

If you are able to appeal your Income-Related Monthly Adjustment Amount (IRMAA), read and understand the entire process upfront so you don’t miss a key deadline.

2025 IRMAA Brackets (Last Year)

Below are last year’s 2025 IRMAA brackets if you still need access to them for your planning:

to $133,000 | to $266,000 | |||

to $167,000 | to $334,000 | |||

to $200,000 | to $400,000 | |||

and less than $500,000 | and less than $750,000 | and less than $394,000 | ||

What Are the 2027 IRMAA Brackets

The official 2027 IRMAA brackets will not be released until the fall of 2026.

However, because your 2025 Modified Adjusted Gross Income (MAGI) determines whether you’ll pay IRMAA surcharges in 2027, it’s necessary to estimate those brackets in advance.

Fortunately, we have a reasonable framework to work from. In 2020, the Medicare Board of Trustees published projected IRMAA adjustments for the years 2021 through 2028. Those projections imply annual inflation adjustments of approximately 6.20% for Medicare Part B and 6.58% for Medicare Part D.

Using that guidance, the table below reflects an estimate of the 2027 IRMAA brackets, assuming 0% inflation from current levels.

If inflation turns out to be higher than 0%, the actual 2027 IRMAA brackets will likely be higher. Conversely, if inflation is lower than expected, the brackets would be lower.

History of IRMAA

While origin stories are interesting, learning the history of an Income Related Monthly Adjustment Amount (IRMAA) can also help us make educated decisions about future adjustments (e.g., 2025 IRMAA brackets, and beyond).

When did IRMAA start?

IRMAA was initially enacted in 2003 as part of the Medicare Modernization Act and only applied to higher-income Medicare enrollees. It wasn’t until 2007 that Income Related Monthly Adjustment Amount (IRMAA) brackets were implemented.

What changes have been made to IRMAA brackets?

There have been two big changes to Income Related Monthly Adjustment Amount (IRMAA) brackets since they were introduced in 2007:

- In 2011, the Affordable Care Act (ACA) expanded IRMAA to include higher-income enrollees in Medicare Part D.

- In 2018, the Bi-Partisan Budget Act created a 5th IRMAA bracket. The stipulation was that this new bracket would not be increased for inflation until at least 2028.

For the last 18 years (2007-2025), IRMAA surcharges have grown steadily. The various Income Related Monthly Adjustment Amount brackets have increased from 4.73% to 8.02%.

How to Plan for Future Medicare IRMAA Brackets

To plan for future medicare IRMAA brackets, estimate your Modified Adjusted Gross Income (MAGI) for upcoming years. Remember that IRMAA tax calculations use your income from two years prior.

Review your financial statements and adjust for any anticipated income changes, such as retirement withdrawals, capital gains, or salary increases.

Long-Term Financial Planning Strategies

Reducing your MAGI is key to avoiding or minimizing IRMAA surcharges. Consider these strategies:

- Roth Conversions: Convert Traditional IRA funds to a Roth IRA in years when your income is lower to reduce future taxable income.

- Tax-Efficient Investments: Invest in tax-advantaged accounts like Roth IRAs or Health Savings Accounts (HSAs) to lower taxable income.

- Charitable Contributions: Donate appreciated assets directly to charity to avoid capital gains taxes.

- Tax-Smart Withdrawals: Develop a tax-smart retirement withdrawal strategy that balances income sources to keep your MAGI within lower IRMAA brackets.

- Skip Insurance Products: While insurance products are pitched as tax-friendly, popular solutions like Indexed Universal Life (IUL) insurance are bad investments that can create unexpected tax liabilities.

By proactively managing your income and employing these strategies, you can effectively plan for future IRMAA Medicare brackets and reduce potential surcharges.

Bottom Line

An Income Related Monthly Adjustment Amount (IRMAA) increases Medicare Part B and Part D premiums for high earners. However, Medicare beneficiaries can employ several strategies to reduce their MAGI and reduce or avoid IRMAA adjustments.

If you only take one thing from this article, it’s that your income this year will affect your IRMAA bracket two years from now.

Beyond managing your income appropriately, understanding the basics of Medicare and periodically reviewing your Part D plan (or Medicare Advantage Plan) can also help you save money on your premiums and future out-of-pocket costs.

Frequently Asked Questions

Your 2025 Modified Adjusted Gross Income (MAGI) determines your IRMAA in 2027. Unfortunately, the IRMAA 2027 brackets will not be announced until the fall of 2026, making it challenging to make tax planning decisions in 2025.

To handle this unknown, you will need to conservatively estimate the 2027 IRMAA brackets. This pesky surcharge has unfortunate aspects, and improvements would help retirement savers plan properly.

MAGI (Modified Adjusted Gross Income) includes your Adjusted Gross Income (AGI) plus certain deductions, such as tax-exempt interest and foreign earned income. It’s used to determine IRMAA brackets, while AGI represents your income before tax deductions.

IRMAA tax brackets are typically adjusted annually based on inflation and legislative changes. These adjustments are announced in the fall and take effect the following year.

If your income significantly decreases due to a life-changing event, you can appeal your IRMAA surcharge using Form SSA-44. If approved, your surcharges may be adjusted, but there is no reimbursement for past payments.

When it comes to Medicare IRMAA brackets, IRMAA surcharges apply to both Medicare Part B and Part D, regardless of whether you have Original Medicare or a Medicare Advantage Plan. The surcharge will be added to your Medicare Advantage Plan premiums.

Capital gains are included in your MAGI calculation and can push you into a higher IRMAA bracket. Strategic tax planning, such as spreading capital gains over multiple years, can help manage this impact.

There are no exemptions from IRMAA based on age or health status. However, you can request a review of your IRMAA determination if you experience specific life-changing events that reduce your income.

Foreign pensions that are taxable in the United States are included in your MAGI. It’s important to account for these when estimating your income for IRMAA purposes.

Failing to pay IRMAA surcharges can result in penalties, including interest charges and potential disruption of your Medicare coverage. It’s crucial to address any discrepancies with the Social Security Administration promptly.

IRMAA surcharges are typically set annually, but if your income changes significantly due to a qualifying life-changing event, you can request an adjustment. Otherwise, surcharges remain constant throughout the year.

IRMAA surcharges are recalculated annually based on your income from two years prior. If your income decreases in subsequent years, your IRMAA surcharge may be reduced or eliminated. However, if your income remains high, you may continue paying IRMAA surcharges yearly.

Additional Medicare IRMAA Resources:

- Will I Avoid 2026 IRMAA Surcharges on Medicare Part B and D? (Free PDF Flowchart)

- IRMAA Fees in Retirement and How To Avoid Them (Peter Lazaroff, Retirement Podcast Network member)

- What You Need to Know About Medicare With Ashby Daniels (Stay Wealthy)

- Retirement Letter to Employer: How to Write One (Stay Wealthy)

Hey there! I’m the founder of Define Financial, a commission-free retirement planning firm ranked #2 in the U.S. by Investopedia. We specialize in helping people aged 50+ reduce taxes, invest smarter, and create a retirement paycheck. I’m also the host of the Stay Wealthy Retirement Show, a Forbes Top 10 podcast and member of the Retirement Podcast Network. When I’m not helping retirees reduce taxes, you can find me traveling with my family, searching for the next best carne asada burrito, or trying to master Adam Scott’s golf swing.