The fintech – or “financial technology” industry has grown exponentially since 2014, when users, investors, and regulators began to take note of the burgeoning market.

In fact, research indicates that, as of 2021, more than 210 million Americans use fintech products.

The number makes up nearly 65% of the American population and has swelled by almost 10 million users since 2018.

Still, many users don’t fully understand the exponential growth of the fintech market.

In this guide, we’ll examine the financial technology sector from a broad perspective. Then, we’ll examine the sector in detail, focusing on market growth, user information, and opportunities presented by the global fintech industry.

Top 10 Financial Technology Stats (Editor’s Pick)

Before you dive in, check out the top ten takeaways that stood out to our team:

Key Takeaways

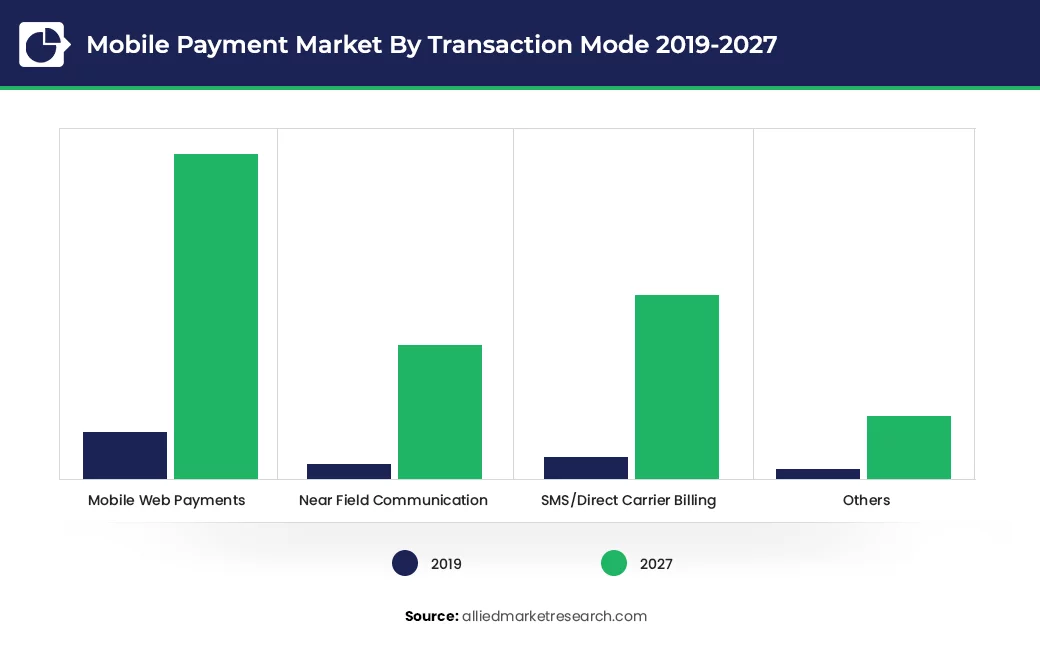

- The mobile payment market will expand at a compound annual growth rate (CAGR) of 30.1% between 2020 and 2027, reaching a market value of $12.06 trillion+.

- Financial technology has a 64% adoption rate.

- As of February 2021, 10,605 fintech startups existed in the Americas.

- The global fintech organization, PayPal, reached a transaction value of more than $330 billion in 2019.

- Alipay, the largest online payment service, had 1.3 billion users in 2020 and processed more than $17 billion in transactions in China alone.

- Apple’s App Store ranks Cash App, Square Inc.’s peer-to-peer payment service, as the most popular fintech app in 2021.

- More than 90% of users will employ financial technologies to make a payment on their mobile devices.

- Mobile financial transactions are expected to grow by 121% by 2022.

- Mobile banking transactions will eventually make up nearly 90% of all bank transactions.

- United States financial organizations that incorporate AI technology could save up to $70 billion in compliance annually.

The Financial Technology Industry

The fintech market presents a significant barrier to entry: upfront investment. Still, even the industry’s harshest critics can’t ignore the shocking fintech growth rate.

The industry leverages advancements such as blockchain technology, distributed computing, and artificial intelligence (AI) interfaces to enhance financial services, including:

- Banking

- Mortgages

- Loans

- Insurance

- Personal finance

- Electronic payment services

- Wealth management

The Fintech industry will continue to grow in the coming years as well. As a result, financial institutions must embrace new technologically-driven solutions or risk losing customers to financial technology pioneers.

Fintech Market Size

Despite the rapidly growing financial technology industry size, it still makes up only a tiny percentage of the global financial services market.

How Much Is the Fintech Industry Worth?

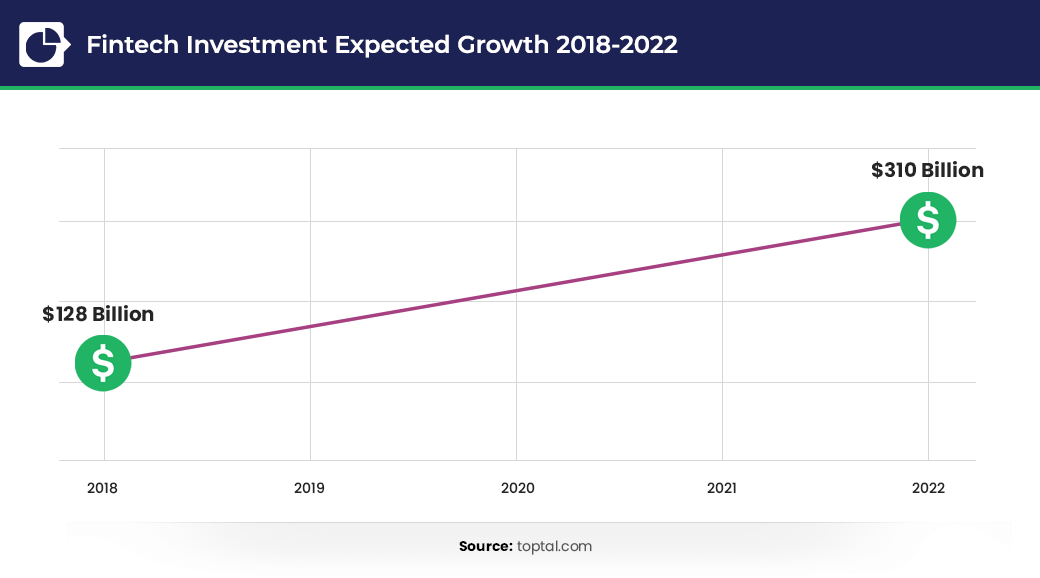

In 2018, the global fintech market size achieved a valuation of $127.66 billion, with an expected annual market growth of about 25% until 2022, reaching as much as $309.98 billion.

Key Stats:

Key Stats:

- Financial technology has a 64% adoption rate.

- 91% of GenX users understand the advantages of mobile fund transfer and financial services.

- Seven of the 500 top fintech companies received $10 billion in total funding.

- Fintech start-ups received nearly half ($128 billion) of all venture capital in 2018 (totaling $254 billion).

- The sector’s funding increased by 82% between 2017 and 2018.

- The mobile payment market is expected to reach a market value of more than $12.06 trillion in 2027.

How Much Is the Fintech Industry Growing?

IDC’s market research organization indicates that the sector’s growth rate will average 25% until 2022, reaching a market value of $309 billion.

The industry’s worth totaled $127.66 billion in 2018.

The sector has experienced evolving market dynamics and currently sits at the intersection of the finance, technology, and entertainment industries.

How Many Financial Technology Companies Exist in the World?

You know the global fintech market has grown rapidly in recent years, but how many fintech companies currently exist?

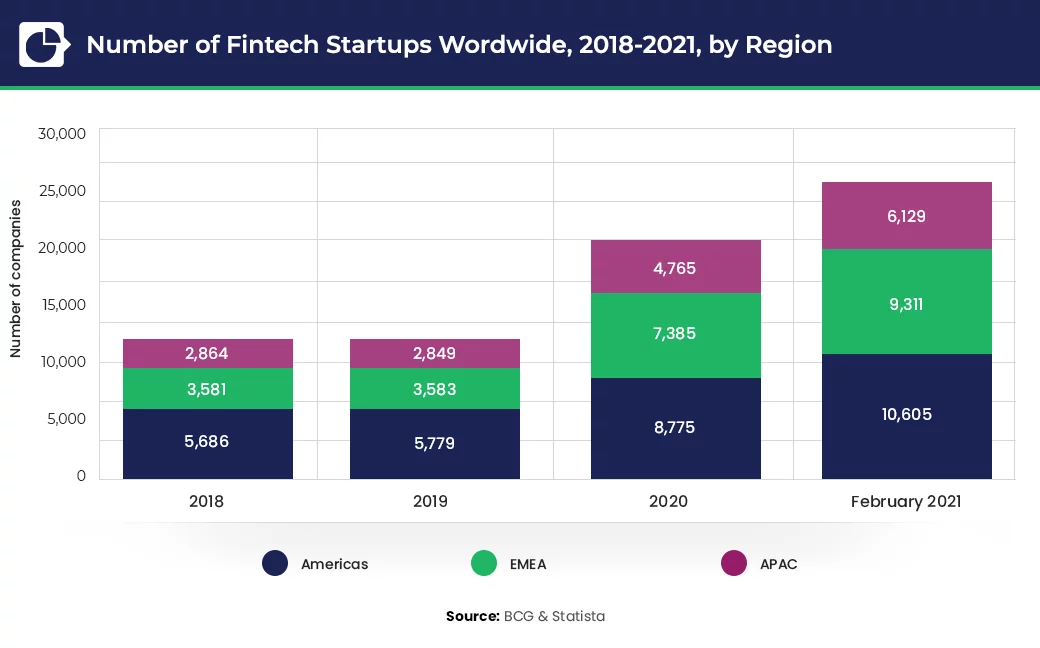

Based on 2021 data, over 26,000 fintech organizations exist worldwide.

More than 10,000 of those financial technology businesses operate within the Americas.

9,311 start-ups have launched from the EMEA (Europe, Middle East, and Africa) region, along with an additional 6,129 in the Asia-Pacific area.

Fintech Market Share by Region: Statistics

The United States and China will account for more than 61% of global fintech transaction value worldwide by 2024.

Still, when comparing the market by region, you’ll quickly notice that nearly 40% of all fintech investment deals exist outside of major financial hubs such as the United States, China, and the United Kingdom.

Key Stats:

- As of February 2021, 10,605 fintech startups existed in the Americas.

- Mobile payments make up the most prominent fintech segment in the United States and Canada.

- Asian countries currently experience the fastest consumer adoption rates.

- The global fintech organization, PayPal, reached a transaction value of more than $330 billion in 2019.

- Art Financial currently holds the largest fintech market share globally, with an estimated value of $150 billion in 2020.

Fintech Companies, Jobs, and Service Statistics

The top financial technology companies include:

| Rank | Company | State | Country | Funding | Industry | Employees |

| 1 | BlockFi | New York | USA | $508.7M | Fintech | 505 |

| 2 | Fast | San Francisco | USA | $124.5M | Fintech | 148 |

| 3 | Public.com | New York | USA | $308.5M | Fintech | 102 |

| 4 | Human Interest | San Francisco | USA | $136.7M | Investments | 282 |

| 5 | M1 Finance | Chicago | USA | $173.2M | Fintech | 250 |

| 6 | Fireblocks | New York | USA | $179M | Fintech | 70 |

| 7 | Chipper Cash | San Francisco | USA | $52.2M | Payments/Transfer | 108 |

| 8 | Finix | San Francisco | USA | $96M | Fintech | 115 |

| 9 | Corvus Insurance | Boston | USA | $145.8M | Fintech | 151 |

| 10 | HomeTown Ticketing | Columbus | USA | Fintech | 109 |

Key Market Dynamics Statistics:

- 88% of incumbent banks and financial groups believe they will lose part of their business to the fintech sector in the next five years.

- As of 2020, 75% of banks have invested in a consumer-centric business model.

- 82% of financial institutions expect to partner with fintech companies in the next three to five years.

- 55% of fintech executives feel that differences in management and corporate cultures create barriers between the fintech market and traditional financial services groups.

Who Are the Major Players in Fintech?

The top 10 fastest-growing fintech companies include:

- Stripe: With an estimated value of $95 billion, Stripe specializes in online payment processing for small businesses, tech giants, and leading e-commerce companies.

- Klarna: Klarna’s value ranks second, with a valuation of $31 billion. The Swedish-based “buy now, pay later” organization offers interest-free financing for online purchases.

- Kraken: Worth an estimated $20 billion, Kraken reigns as the top cryptocurrency exchange platform in Europe and the second-largest in the United States.

- Chime: Chime’s fee-free checking accounts, overdraft protection, and beginner-friendly debit and credit cards have resulted in a valuation of $14.5 billion.

- Plaid: Valued at $13.4 billion, Plaid allows fintech companies like Venmo and Robinhood to connect to their users’ bank accounts.

- Robinhood: Robinhood’s mobile trading app boasts more than 13 million users and a valuation of $11.7 billion.

- Brex: Brex has built a $7.4 billion company selling products to other start-ups, including cash management accounts and corporate credit cards.

- Carta: Carta’s cloud-based capital tracking organization reached a total value of $6.8 billion in less than a decade.

- Gemini: With a market worth of $5 billion, Gemini’s cryptocurrency exchange manages roughly $30 billion in transaction value every year.

- Wise: Like Gemini, Wise boasts a $5 billion total value. The fund transfer service facilitates international exchanges with minimal fees.

Which Is the Most-Used Fintech Service?

While the global fintech market share encompasses several offerings, banking and payments remain the most popular fintech worldwide service. Nearly 60% of account holders have used mobile banking and payment platforms to receive payments, complete purchases, and transfer funds.

Key Fintech Service Statistics:

- Stripe, the top Fintech company in the U.S., offers online payment processing services for e-commerce companies.

- With 1.3 billion users in 2020, Ant Financial’s Alipay processed more than $17 billion in transactions in China alone.

- Apple’s App Store ranked Cash App, Square Inc.’s peer-to-peer payment service, as the most popular fintech app in 2021.

Job Statistics: Does Fintech Pay Well?

If you’re wondering, “How much does a job in fintech pay?” you’re not alone.

The average salary in fintech lands around $125,000 per year. Entry-level workers typically take home nearly $87,000 each year, while a United States-based app developer can typically expect to make $131,000 per year.

You likely don’t have to worry about running out of job opportunities in the fintech market, either.

More than 10,000 financial technology companies conduct business in the United States, while more than 15,000 organizations exist in Europe, Asia, the Middle East, and Africa.

Key Market Salary Information:

- The average salary in fintech is roughly 400% higher than the median American salary.

- The median salary for a software engineer at Stripe, the top financial tech company in the United States, falls between $100,000 and $240,000 per year.

- The demand for skilled blockchain developers increased by 3,500% in 2018.

Consumers Using Fintech Statistics

Financial technology includes various systems, products, and AI-powered advances that optimize, enhance, and automate financial services.

It also offers more than just mobile banking and payment options. The fintech sector now includes products and services such as:

- Fundraising

- Wealth management

- Retail banking

- Personal finance education

Fintech Consumer Adoption Statistics

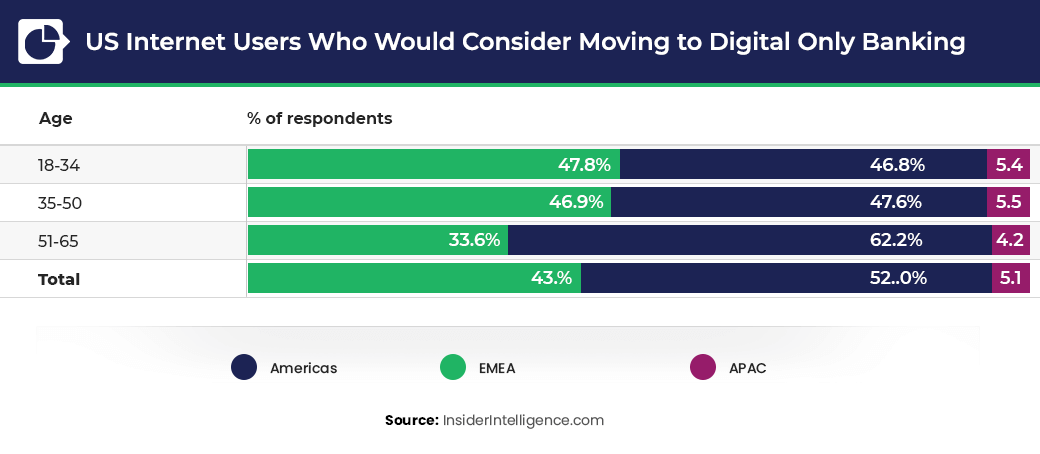

Fintech adoption rates have continued to increase, with more than 75% of consumers worldwide adopting some type of mobile fund transfer or payment method in 2019.

Key Consumer Adoption Rate Data:

- Mobile financial transactions are expected to grow by 121% by 2022.

- More than 90% of users will use financial technologies to make a mobile payment.

- Mobile banking transactions will eventually make up nearly 90% of all bank transactions.

- Fintech industry trends predict that 78% of the United States’ millennial citizens will use digital banking tools by 2022.

What Are Fintech Products?

Generally speaking, you can divide the fintech market into four categories based on specific client pools:

- Business-to-business (B2B) for banks

- B2B systems for business customers

- Business-to-consumer (B2C) products and services for small organizations

- B2C offerings for consumers

Within these categories, you will find a wide range of organizations that provide products and services related to consumer banking (e.g., MaxMyInterest), business payment processing, and personal finance solutions.

What is the Fintech Industry?

Before you can define the fintech industry, you need to know the answer to another question: “What is financial technology?”

Fintech includes integrative systems such as Artificial Intelligence (AI), blockchain technology, and distributed computing.

The financial technology industry business model typically entails developing and providing these technologies to banks and other financial companies in order to improve their customer experience, expand mobile banking and payments, deliver personal finance tools to consumers, and stand out from their competition.

Types of Fintech Companies

The fintech market sees new businesses launch every day, thanks to the limitless opportunities and optimistic growth forecast inherent to the industry.

With that in mind, some of the most common types of fintech organizations include:

- Peer-to-peer (P2P) payment methods

- E-commerce payment processing tools

- International fund exchanges

- Wealth management tools

- Investment platforms

- Consumer banking tools

Most Popular Payment Gateway Systems

The top 10 payment gateways include:

- PayPal: Since its launch in 2002, PayPal has become the most popular fintech payment processing company in the United States. The low-cost, secure platform allows you to collect domestic and international payments through your website and social media.

- Stripe: Stripe has become PayPal’s most formidable contender when it comes to user experience and market share. The platform allows customers to make payments without leaving the site and now accepts cryptocurrencies.

- Amazon Pay: Small- and medium-sized businesses have begun to turn to Amazon Pay for a secure, simplified user experience. The API-powered platform works with a variety of e-commerce websites and even offers an in-store checkout portal.

- Authorize.net: Authorize.net’s flexible payment gateway features advanced security to prevent fraud. At the same time, business owners can enjoy unlimited transactions and immediate cash transfers.

- WePay: More than likely, you know WePay as a crowdfunding site. However, the service provider also offers a user-friendly payment gateway for e-commerce businesses.

- Square: Square’s on-site payment gateway eliminates the hassle of establishing a point-of-sale (POS) system. The virtual terminal allows you to scan cards and take payments from your computer, tablet, or mobile device.

- FirstData: FirstData’s payment gateway accepts virtually every major card, making it a favorite e-commerce service for credit card processing companies.

- 2Checkout: While 2Checkout doesn’t have the market size of competitors like PayPal and Stripe, the payment gateway works in more than 200 countries and can process over 80 currencies.

- Merchant e-Solutions (MeS): MeS provides streamlined integration and secure payment processing for its users. Using its POS system, you can easily manage on-site transactions and accept online payments from more than 150 countries.

- SecurePay: SecurePay’s payment gateway provides small- and medium-sized e-commerce businesses with an easy way to collect online payments.

Fintech Stock & Market Statistics

Each year, more businesses work to broaden their fintech market share. Fortunately, the most recent data proves that the industry has plenty of room to grow. As a result, recent studies have shown that:

- The fintech market has seen some of the largest investments in history, reaching $14 billion in a single investment round.

- The industry can continue to evolve after the impact of COVID-19 by leveraging online banking and personal finance tools, e-commerce payment processing, and other digital resources.

- The fintech market includes almost 80 privately owned “unicorn” fintech companies with a value of $1 billion or more.

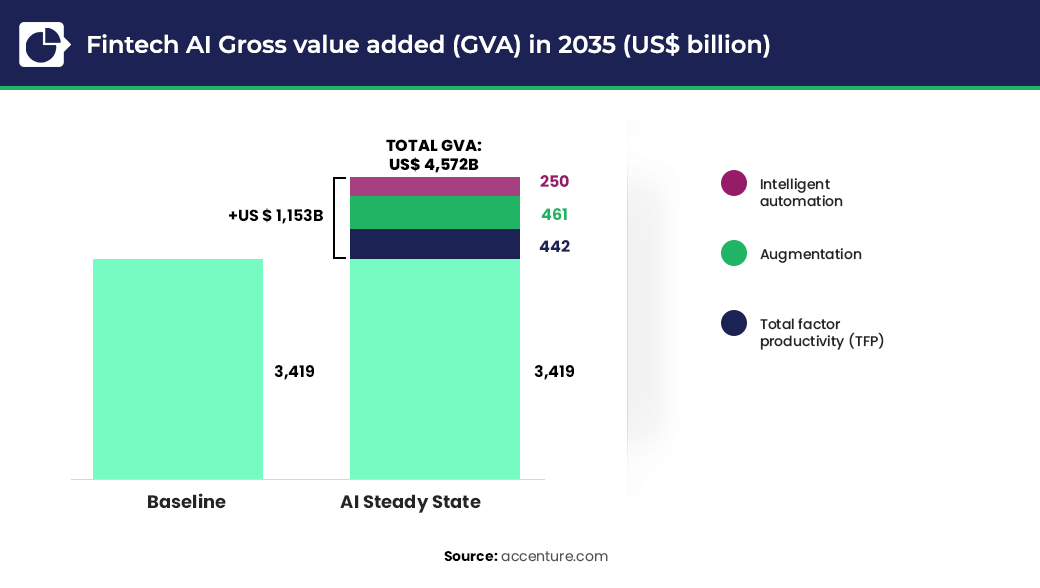

Artificial Intelligence Use in Fintech Statistics

Fintech AI statistics show that the technology reached an estimated value of $7.91 billion in 2020. The market forecast indicates that artificial intelligence technology will continue to experience a CAGR of 23.17% between 2021 and 2026 before reaching an expected $26.67 billion.

Key AI Market Share Information:

- Banks can make an additional $300 million in revenue for every $1 billion invested in AI.

- Roughly 70% of organizations in the financial service market use some form of machine learning.

- United States banks that incorporate AI technology could save up to $70 billion in compliance annually.

Fintech Use in Mobile Statistics

In 2020, 86.5% of United States citizens used a mobile device to check their bank account balances.

During this period, Americans made and received payments totaling $503 billion.

In 2021, a whopping 5.22 billion users worldwide utilized mobile banking platforms, with Bank of America’s mobile app leading the market with 30 million users.

Key AI Market Forecast Information:

- 79% of smartphone users have made an online purchase in the last six months.

- 90% of smartphone owners will make a mobile payment in 2021.

- Fraudulent mobile app transactions have increased by more than 600% since 2015.

- Rogue mobile apps account for roughly one in every 20 fraudulent attacks.

- Loss due to mobile fraud reached more than $40 million in 2019.

Fintech Blockchain Statistics

Nearly one out of every four people worldwide is familiar with blockchain technology.

Experts forecast that the blockchain tech market will reach a staggering $20 billion by 2024. At the same time, annual revenue will likely increase by as much as 139% between 2019 and 2023.

Key Blockchain Market Data:

- Blockchain-powered P2P lending is expected to experience a market size increase of 26.6% between 2018 and 2026.

- Blockchain technology brings several opportunities for bank savings, totaling more than $27 billion by 2030.

- Blockchain value will reach more than $3.1 trillion by 2030.

Future Predictions for Fintech

Research shows that fintech organizations weathered the impact of COVID-19 in 2020 relatively well.

Fintech predictions indicate that the market will continue to grow and thrive in 2021, especially as the innovative sector goes on to provide additional resources to consumers navigating the lingering effects of the pandemic.

As the fintech market size continues to expand, businesses and customers have the opportunity to take unprecedented control of their finances.

Even so, the emerging market still has room to grow before it reaches its predicted value of $309.98 billion.

While the fintech market offers countless exciting opportunities and shocking data, perhaps the most surprising statistic involves a simple payment.

As more users make mobile payments, the market growth rate will exceed 30% and reach a value of $12.06 trillion by 2027.

Hey there! I’m the founder of Define Financial, a commission-free retirement planning firm ranked #2 in the U.S. by Investopedia. We specialize in helping people aged 50+ reduce taxes, invest smarter, and create a retirement paycheck. I’m also the host of the Stay Wealthy Retirement Show, a Forbes Top 10 podcast and member of the Retirement Podcast Network. When I’m not helping retirees reduce taxes, you can find me traveling with my family, searching for the next best carne asada burrito, or trying to master Adam Scott’s golf swing.